The world of non-fungible tokens (NFTs) has been abuzz with activity as of late, with industry leaders and high-profile investors closely monitoring the ebbs and flows of this rapidly evolving digital asset class. One such individual who has captured the attention of the NFT community is none other than billionaire Mark Cuban, the renowned entrepreneur and owner of the NBA’s Dallas Mavericks. In a surprising turn of events, Cuban’s digital wallet, identified by the Ethereum Name Service (ENS) domain “markcuban.eth,” has recently emerged from a two-year dormancy to offload a significant portion of his extensive Ethereum NFTs collection, sparking speculation and intrigue within the cryptocurrency ecosystem.

Mark Cuban’s Sudden NFT Liquidations

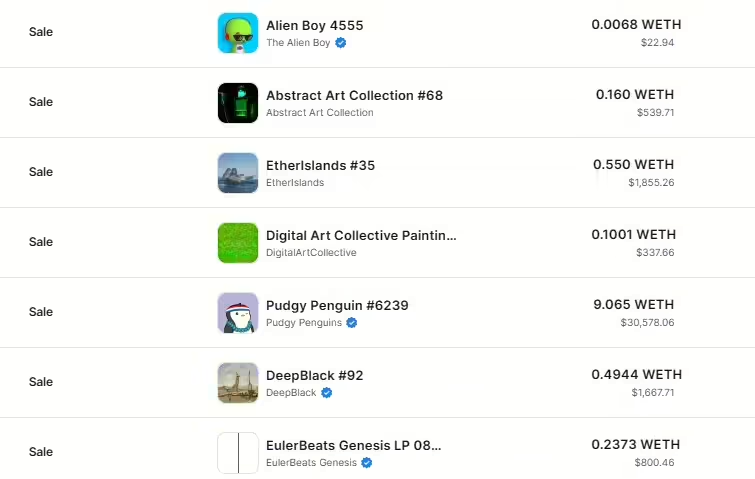

According to data from the leading NFT marketplace OpenSea and Etherscan data, Mark Cuban’s wallet has been actively selling off a variety of NFTs over the past couple of days. This sudden flurry of activity marks a stark contrast to the wallet’s prolonged inactivity, which had lasted for nearly two years.

Read More: Billionaire Mark Cuban Falls Victim to Gmail Hack After Spoofed Google Call

The NFTs being sold by Cuban span a diverse range of collections, including the popular Pudgy Penguins NFT, EulerBeats Genesis, DeepBlack NFTs, and Wrapped MoonCats. Among the most notable transactions was the sale of a Penguins NFT, which fetched a remarkable 9.065 Wrapped Ether (WETH), equivalent to approximately $30,578 at the time of the sale.

Potential Motivations Behind Cuban’s NFT Sell-Off

The timing of Cuban’s NFT liquidations has raised eyebrows within the crypto community, as it coincides with a broader downturn in the NFT market trends. In recent months, the overall sales volume and floor prices of prominent NFT collections, such as the Bored Ape Yacht Club (BAYC), have experienced a significant decline.

Some industry analysts have speculated that Cuban’s actions may be a strategic response to these NFT market trends, with the billionaire potentially looking to rebalance his NFT investment portfolio or capitalize on the current market sentiment. Others have suggested that the sell-off could be unrelated to broader NFT trends and may be driven by personal or financial considerations. Regardless, the NFT news has sparked numerous NFT rumors and discussions about the NFT value and future of NFT trading.

Cuban’s Extensive NFT Holdings and Future Plans

Despite the recent wave of NFT sales, Cuban’s digital wallet still contains a substantial NFT portfolio, valued at over 1,900 ETH, or approximately $6.2 million based on current NFT market value. This vast portfolio underscores the investor’s long-standing interest and involvement in the NFT space, which dates back to the industry’s meteoric rise in 2021.

In addition to the NFTs being sold, Cuban has also listed two high-value digital assets for sale. One is a HASHTAG NFT from the Proof of Culture series, priced at 15 ETH (around $50,194), while the other is a BibleNFT piece titled “Deuteronomy 25:4,” listed for 5 ETH (approximately $16,000). If these items are successfully sold, Cuban’s wallet would have offloaded over $100,000 worth of NFTs in the span of just a few days, further contributing to the ongoing NFT market news and analysis.

The Broader Implications of Cuban’s NFT Sell-Off

Cuban’s sudden foray into the NFT liquidation market has not gone unnoticed, with the crypto community closely monitoring the potential ripple effects of his actions. Some industry observers have speculated that the billionaire’s moves could signal a broader shift in sentiment within the NFT landscape, potentially influencing the NFT investment strategies of other high-profile players.

Moreover, the timing of the sales has fueled discussions about the overall health and direction of the NFT market trends. As the industry navigates a period of volatility and uncertainty, the actions of influential figures like Mark Cuban are being closely scrutinized for insights into the future trajectory of this rapidly evolving asset class.

Regulatory Concerns and Security Challenges

The events surrounding Cuban’s NFT sell-off have also highlighted the ongoing regulatory and security challenges that continue to plague the crypto and NFT industries. Just prior to the recent liquidations, the billionaire’s Gmail account ([email protected]) was reportedly compromised in a security incident, leading to concerns about the potential impact on his digital asset holdings and the need for secure transactions.

As the NFT market matures, industry stakeholders, including high-profile investors, must remain vigilant in addressing these critical NFT security issues. Robust security measures, enhanced NFT regulations and regulatory frameworks, and increased transparency will be crucial in fostering a more stable and trustworthy environment for the continued growth and adoption of non-fungible tokens.

Conclusion

The case of Mark Cuban’s NFT sell-off has captivated the attention of the crypto community, serving as a microcosm of the broader NFT trends and dynamics shaping the non-fungible token landscape. As the industry navigates a period of volatility and uncertainty, the actions and decisions of influential figures like Cuban will continue to hold significant sway, offering valuable insights into the future direction of this rapidly evolving digital asset class.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.