In a remarkable turnaround, Bitcoin, the leading cryptocurrency, has staged a significant resurgence, reclaiming the coveted $60,000 mark and propelling its market capitalization back above the $1 trillion threshold. This Bitcoin price surge has been fueled by a surge in institutional investment, as evidenced by the substantial Bitcoin ETF inflows.

Bitcoin’s Remarkable Rebound

The cryptocurrency’s price has seen a remarkable recovery, surging approximately 25% from its recent lows of $49,000 despite some Bitcoin struggles. This upward trajectory, or Bitcoin rally, has firmly reestablished Bitcoin as a $1 trillion asset class, a testament to its growing mainstream adoption and recognition as a viable investment option.

Spot Buying Frenzy

On Aug. 8, the market witnessed a substantial influx of buying activity, with $430 million in spot buying delta recorded. The Spot Cumulative Volume Delta (CVD), which tracks the net difference between buying and selling volumes, indicated the largest spot buying day since May 20, when Bitcoin reached $70,000. This surge in spot buying was a key driver behind Bitcoin’s impressive 12% gain on the day, marking its best performance since February 2022. Spot Bitcoin ETFs saw significant activity and Bitcoin ETF trading volumes were high.

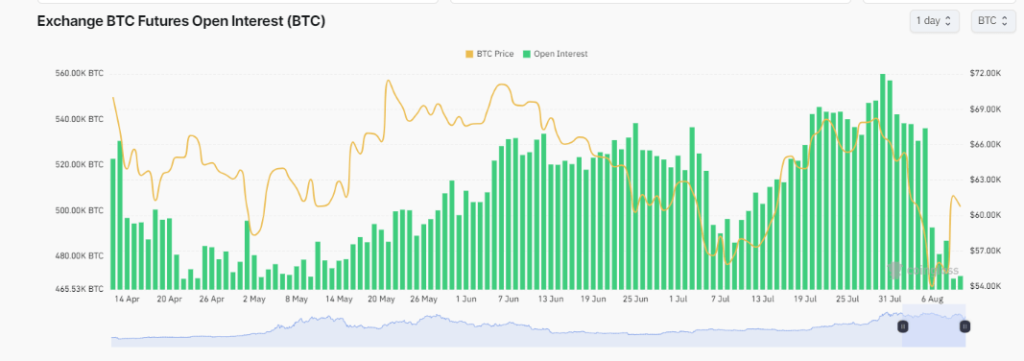

Lack of Increased Open Interest

Interestingly, despite the Bitcoin price increase, open interest in Bitcoin barely increased. The last time Bitcoin was at $60,000, on Aug. 4, there were 530,000 BTC allocated in open interest contracts, according to Coinglass data. This figure has since decreased to 471,000 BTC, suggesting that the rally was primarily driven by spot buying activity and institutional buying of Bitcoin rather than leveraged trading.

Related Read: Binance Labs Invests in Solana Restaking Ecosystem, Solayer

Institutional Inflows Fuel Bitcoin’s Resurgence

The resurgence in Bitcoin’s price coincided with notable crypto inflows of $194.6 million into Bitcoin ETFs, marking the most significant inflow since July 22. This institutional capital influx has played a crucial role in propelling Bitcoin’s recovery.

BlackRock Leads the Charge

Leading the charge was BlackRock’s IBIT, which saw a $157.6 million inflow, its largest since July 29. This significant investment from the world’s largest asset manager underscores the growing institutional appetite for Bitcoin exposure. The news of a potential Bitcoin ETF approval for BlackRock has generated significant Bitcoin news coverage.

Other Notable Inflows

In addition to BlackRock’s IBIT, Fidelity’s FBTC saw an inflow of $65.2 million, the first since July 26. Ark’s ARKB and WisdomTree’s BTCW also recorded inflows of $32.8 million and $118.5 million, respectively. These inflows from prominent financial institutions further validate Bitcoin’s position as a mainstream investment asset. Bitcoin mining news has also been positive, with the network hashrate reaching new highs, indicating continued investment in Bitcoin miners and mining infrastructure.

Factors Driving Bitcoin’s Recovery

Several factors have converged to propel Bitcoin’s remarkable recovery, including:

- Increased Institutional Adoption: The influx of institutional capital, as evidenced by the substantial inflows into the largest Bitcoin ETFs, has been a significant driver of Bitcoin’s resurgence. Bitcoin ETF inflows today and overall Bitcoin ETF flows underscore the growing recognition of Bitcoin as a legitimate and viable investment asset among mainstream financial institutions. Bitcoin inflows from hedge funds and other institutional players are providing increased liquidity to the financial markets.

- Reduced Volatility: Despite the recent price fluctuations, Bitcoin has exhibited relatively lower volatility compared to its historical norms. This stability has helped to instill confidence among investors, both institutional and retail, in the long-term potential of the cryptocurrency.

- Regulatory Clarity: Ongoing regulatory developments and increased clarity surrounding the cryptocurrency industry, including potential SEC approval and enhanced regulatory oversight, have helped to mitigate concerns and foster a more favorable environment for Bitcoin’s growth.

- Technological Advancements: Continuous improvements in Bitcoin’s underlying technology, such as enhanced scalability, security, and usability, have contributed to its increased Bitcoin adoption and acceptance among both individual and institutional investors.

- Macroeconomic Factors: Broader macroeconomic conditions, including concerns over inflation trends and the potential for a global economic downturn reflected in US Treasury yields, have led some investors to view Bitcoin as a hedge against traditional financial market risks, further bolstering its appeal as a store of value.

Cautionary Considerations

While the recent resurgence in Bitcoin’s price and institutional investment activity is undoubtedly positive, it is important to note that the cryptocurrency market volatility remains high and subject to significant risks. Investors should exercise caution and thoroughly research the market, considering factors like trading volume and prevailing market sentiment, before making any investment strategies decisions regarding digital assets like Bitcoin or attempting risky arbitrage trades.

Conclusion

Bitcoin’s remarkable recovery, marked by its resurgence above the $60,000 level and the restoration of its $1 trillion market capitalization, has been driven by a surge in institutional investment. The substantial inflows into Bitcoin ETFs, led by industry giants like BlackRock, underscore the growing mainstream acceptance and recognition of the cryptocurrency as a viable investment asset.

As the market eagerly anticipates the launch of Bitcoin ETF options and potential spot Bitcoin ETFs, the stage is set for continued growth and innovation within the cryptocurrency ecosystem. Increased investor confidence and the growing Bitcoin narrative of Bitcoin as an accumulation strategy and inflation hedge are key trends to watch.

However, retail investors and institutions alike must remain vigilant and conduct thorough due diligence to navigate the inherent risks associated with the volatile cryptocurrency market. The future trajectory of Bitcoin futures, including CME Bitcoin futures, and overall ETF inflows will be important indicators of continued institutional involvement in the space.