The crypto market has been on a wild ride in 2024, with Bitcoin (BTC) often called digital gold leading the pack. After a strong start to the year, the top cryptocurrency faced tough times in September, a month with a history of poor performance. But this year has broken the mold, as Bitcoin price jumps by an impressive 10.1% in the last 30 days shattering the September “curse” and kicking off a wider crypto market upswing.

Breaking the September Pattern

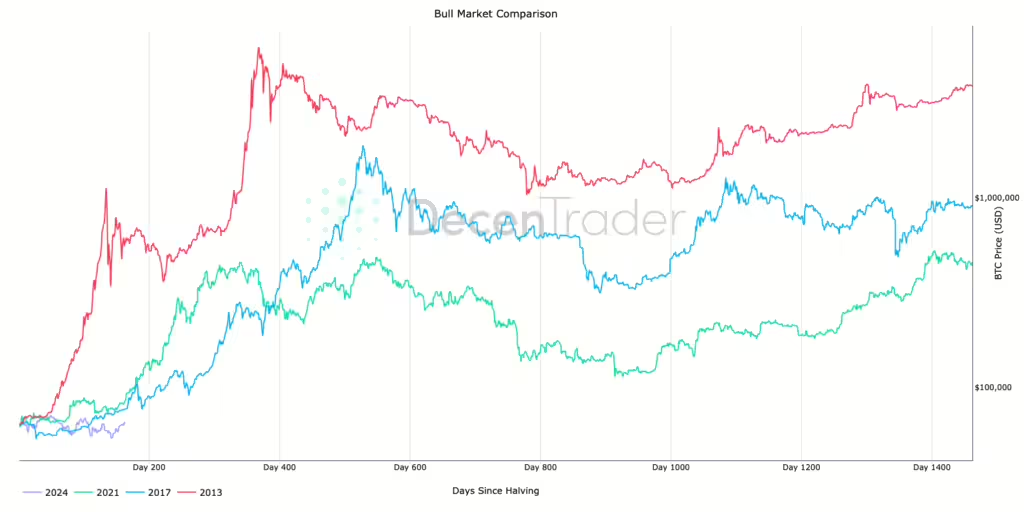

Bitcoin’s performance in September has been a hot topic among crypto enthusiasts. In the past, this month has proved tough for the asset, with the market seeing gains. Since 2017, Bitcoin has made money once in September, with a small 3.99% profit in 2023, as shown on the Bitcoin bull run history chart. This year though, the story has changed, and Bitcoin has beaten the odds sparking a big Bitcoin rally today.

How Interest Rate Cuts Affect the Market

The main reason for Bitcoin’s recent rise has its roots in the steps taken by central banks worldwide. In September, the US Federal Reserve made a decision to lower interest rates at the FOMC meeting. Other major central banks, like the European Central Bank and the People’s Bank of China soon followed suit. These Fed rate cuts had a major effect on BTC interest rates and the wider crypto bull market.

The interest rate cuts have an impact on Bitcoin’s price, which is worth noting, as the asset tends to move with US monetary policy. Investors saw a chance when more money became available and jumped into action pushing Bitcoin up as as September 7th. The CME FedWatch Tool and Fed CME numbers backed up what the market thought about loose money policies staying around adding fuel to the Bitcoin climb we see today.

Related Read: Ultimate Guide to Memefi Airdrop: Step-by-Step Instructions

The Coinbase and Spot ETF Volume Surge

The latest Bitcoin jumps have gone hand in hand with more money flowing into spot exchange-traded funds (ETFs) and a jump in Coinbase trades. The spike in Coinbase trading, which many see as a sign of U.S. retail investor interest, has hit its highest point in two weeks. This points to more buyers entering the market and a change in how people feel about it.

What’s more, the total spot volume difference across all exchanges reached a new high for the month, with buying volumes taking the lead. This wave of buying has added fuel to Bitcoin’s climb today, as investors try to cash in on the coin’s new momentum and the chance of a wider rise in other cryptocurrencies.

Hopes for Crypto-Friendly Rules

People who are into crypto still feel good about where Bitcoin is heading. Many think the next group running the US will have to make rules that are nicer to crypto and deal with worries about crypto regulation. Crypto has been a big deal in the race for president so folks expect the new leaders will listen more to what the crypto world needs. This might make the SEC go easier on digital money.

If this prediction comes true, it might have a positive impact on Bitcoin’s value and the Bitcoin stock index, as investors expect a more supportive regulatory scene. People who back Bitcoin hope it will soon reach its peak price of $73,000 again and maybe even go higher soon, due to more big companies buying in and more people using digital money.

The Current Sell-Off Craze

As Bitcoin prices keep climbing, the market has seen a big jump in trader liquidations. In the last day, over 72,000 traders got liquidated, with the key period being the last 12 hours. During this time, traders worth $26.71 million in total were liquidated as BTC prices kept going up with only small dips.

This liquidation spree shows the market’s bullish mood, as traders betting on price drops have to close their positions pushing prices even higher. But it also points out the risks of trading with too much borrowed money, as sudden price shifts can cause big losses.

Technical Analysis: Bull Signals Are Everywhere

The Bitcoin price movement shows many bull signals from a technical analysis standpoint. The 20-day exponential moving average (EMA) at $65,466 is going up, and the relative strength index (RSI) stays in the positive area. This means the price will keep rising.

If buyers push the price over the $66,700 resistance point, the BTC/USDT pair might jump to $70,000. But bears will try hard to stop Bitcoin in the $70,000 to $73,777 range. They want to keep Bitcoin from hitting new record highs.

The Chance of an “Uptober” Jump

Now that September’s bearish curse has ended crypto enthusiasts look forward to a possible “Uptober” Bitcoin surge driven by Uptober rally expectations. This phrase points to Bitcoin’s past success in October often bringing big gains and boosting Q4 results.

The current momentum and positive outlook for Bitcoin suggest it might keep climbing and reach $70,000 in the next few weeks. Keep in mind that the market can change , and unexpected events could affect the BTC price.

Factors Affecting the Potential Retracement

While Bitcoin’s recent price jumps catch the eye, signs point to a possible dip in the short term. The “shooting star” pattern on the hourly chart often signals a downturn hinting at market resistance at current prices.

Also, the RSI hovering near overbought territory suggests buying pressure might slow down leading to a price drop. If Bitcoin doesn’t end the day above $65,000, we could see a slide back to $64,000 or even $63,200 support levels.

Why Traders Should Stay Alert

As Bitcoin’s market keeps showing big ups and downs, traders and investors need to be careful and stay balanced. The recent price jump was good news, but we should remember that the crypto market can surprise us, and prices could drop too.

Traders should think about how to handle risk. They need to set up stop-loss orders and not borrow too much money to trade. By being smart and sticking to a plan, investors can deal with the market’s ups and downs. This might help them make the most of Bitcoin and other cryptocurrencies in the long run.

How New Rules Affect the Market

The crypto world is keeping a close eye on how different countries handle digital money rules. Governments and financial watchdogs worldwide are trying to figure out how to deal with these new assets. The upcoming U.S. presidential vote might change how crypto is regulated, which could affect Bitcoin’s price in the future.

If the new leaders in charge are more open to crypto more big companies might start using it, and prices could go up. But if they make stricter rules, it could slow down the industry’s growth and maybe cause prices to fall.

What’s Next for the Wider Crypto Market

Bitcoin grabs most of the spotlight, but we need to look at the whole crypto market and how it affects BTC’s price. How other coins like SPX coin and Solana do, plus how people feel about digital money and start using it, can shape where Bitcoin’s price goes.

As crypto keeps changing, we’re seeing new things pop up like decentralized finance (DeFi) non-fungible tokens (NFTs), and other fresh ideas such as Socket Network and account abstraction. These developments might shake up the market changing Bitcoin’s standing and how its price moves. People who invest and study the market will need to watch these changes to get a better grip on what’s shaping crypto’s future.

Conclusion: Cautious Optimism for Bitcoin’s Future

The latest jump in Bitcoin price breaking the September “curse,” has brought back hope to the crypto world. A mix of good money policies more interest from big companies and everyday investors, and the hope for crypto-friendly rules have all helped the asset do well.

But we need to be careful, since the crypto market can change . People who trade and invest should think hard about how much risk they can take, use good ways to manage risk, and keep an eye on how rules and markets are changing.

As crypto becomes more common and accepted, Bitcoin and other digital currencies look good for the long haul. To make the most of what’s coming, investors should stay in the know, be careful, and embrace how this tech can change things. This way, they can deal with the bumps in the road and grab the chances that pop up.

FAQ

What caused the recent surge in Bitcoin price?

The recent surge in Bitcoin’s price can be attributed to the actions of central banks around the world, particularly the interest rate cuts announced by the US Federal Reserve during the FOMC meeting, followed by similar actions from other major central banks. These rate cuts had a significant impact on BTC interest rates and the broader crypto bull market.

What factors have contributed to the recent surge in Bitcoin’s price?

The recent surge in Bitcoin’s price has been influenced by a surge in spot exchange-traded fund (ETF) inflows, a spike in Coinbase trading volume, and the anticipation of more crypto-friendly policies. Additionally, the market has witnessed a significant increase in trader liquidations, signaling a bullish sentiment, and technical analysis has shown several bullish signals.

What are the potential factors affecting Bitcoin’s future price movements?

The potential factors affecting Bitcoin’s future price movements include the impact of regulatory developments, the broader cryptocurrency market outlook, and the anticipation of a potential “Uptober” rally. Additionally, technical analysis signals, the ongoing liquidation frenzy, and the importance of cautious trading are key considerations for understanding Bitcoin’s future trajectory.

How should traders and investors approach the current market dynamics?

Traders and investors should exercise caution, maintain balanced risk management strategies, and stay informed about regulatory and market dynamics. It is crucial to be mindful of potential retracement factors, stay alert to new rules’ impact, and consider the broader cryptocurrency market outlook while navigating the ongoing market fluctuations.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.