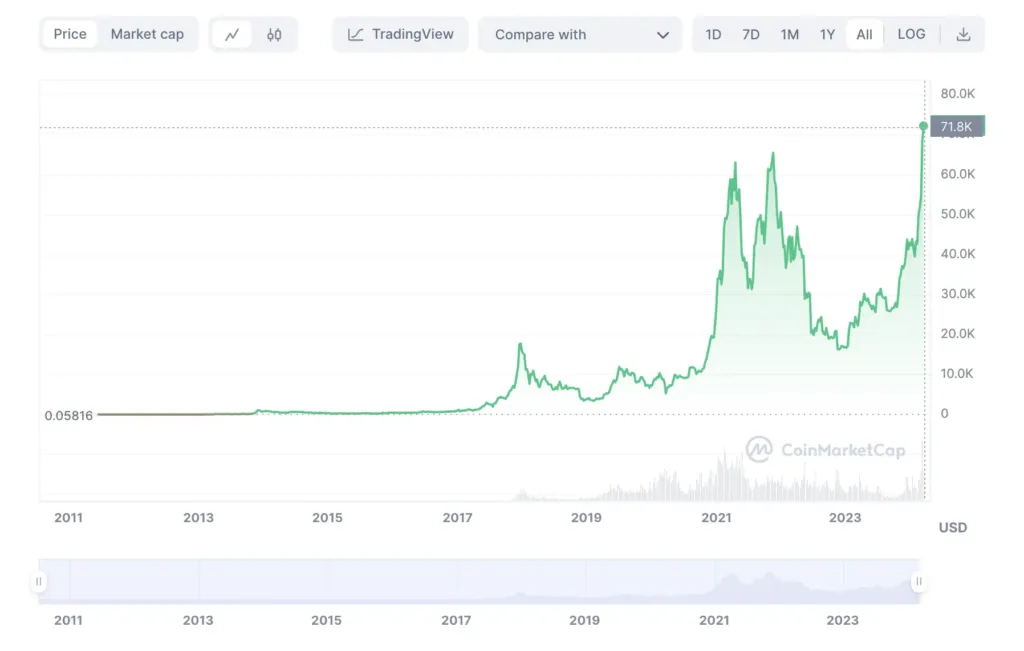

Bitcoin surpasses silver to become 8th most valuable commodity on this earth. Cryptocurrency aficionados have celebrated a significant milestone in the digital asset realm, with Bitcoin, the titan of cryptocurrencies by Market Cap, experiencing a surge in Value, eclipsing silver and claiming the title of the 8th most valuable asset worldwide. This landmark event has ignited a wave of excitement and speculation in the investor community, underscoring the escalating importance of Cryptocurrency in today’s financial sphere. Bitcoin yesterday rose to 72K USD, pushing aside silver to come to 8th most valuable thing on the whole wide world. While some bitcoin enthusiast are speculating that it will soon cross the Coveted ALPHABET, which is 7th most valuable company in this world and has a market cap of 1.7T usd, but that has to been.

In the past few years, Bitcoin has seen extraordinary growth, seizing the spotlight from both institutional and individual investors. Its astronomical ascent is credited to a mix of factors, such as broader adoption, positive regulatory shifts, and a surge in Market Cap interest. Consequently, the Price of Bitcoin has soared, setting unprecedented highs and eclipsing numerous significant benchmarks.

A notable achievement is Bitcoin’s Market Cap, a metric that quantifies the aggregate Value of all circulating Bitcoin. With a Market Cap of a staggering $1.4 trillion, Bitcoin now ranks as the 8th largest financial asset globally, a milestone that underscores its dominance over Silver, the commodity in second place with a Market Cap of $1.381 trillion.

Despite its history of Price Volatility, Bitcoin has recently charted a consistent upward course, drawing both acclaim and skepticism. This steady rise in Price is propelled by heightened interest from institutional investors and a trend towards mainstream Cryptocurrency acceptance. This is due to fact that Bitcoin ETF now hold 44 billion dollars of Bitcoin in their trusts with in the first month of their inception. That kind of fundholding is unprecedented in the history of financial institutions.

Merely a few years back, Bitcoin was trading in the $20,000 to $30,000 range, with doubts cast on its efficacy as an inflation hedge. Yet, the narrative took a turn in June when Blackrock, the globe’s preeminent asset manager, announced plans for a spot Bitcoin ETF, a development that the Cryptocurrency community hailed as a significant endorsement, sparking a surge in Bitcoin’s Price.

Come January 2024, the SEC’s approval of nearly a dozen Bitcoin ETFs injected fresh momentum, propelling Bitcoin’s Price to unprecedented peaks. This rally led to Bitcoin shattering its 2021 Record High, with a Price peak of $72,271. Consequently, Bitcoin Marketcap ballooned past $1.4 trillion, outstripping Silver and cementing its status as the 8th largest global financial asset.

Read This : Can bitcoin reach 100,000 in 2024

Some authorities in the field speculate that the Price of Bitcoin could soar to $100,000 or beyond , as the Cryptocurrency cements its status as a mainstream investment and garners broader acceptance among institutional investors and the public. Nonetheless, it’s essential to remember that the Cryptocurrency markets are characterized by high Volatility, and thus, price forecasts should be approached with prudence.

While the ascent of Bitcoin has largely been a boon, the Cryptocurrency faces Regulatory challenges that could pose obstacles to its continued prominence. Governments and regulatory entities across the globe are in the throes of figuring out how to regulate cryptocurrencies, aiming to balance Market Impact with the need for investor protection while still encouraging innovation.

The prospect of stringent Regulatory measures or adverse decisions could cast a shadow on Bitcoin’s market potential and dampen Investor Confidence. For the Cryptocurrency sector, it is imperative to engage in collaborative efforts with regulators to forge clear guidelines and frameworks that underpin responsible and sustainable growth.

In the ever-evolving cryptocurrency ecosystem, it’s imperative for stakeholders, including investors, regulators, and industry experts, to steer this dynamic domain with prudence and synergy. Championing innovation, striving for regulatory transparency, and enhancing investor education are pivotal steps to harness Cryptocurrency’s potential, drive Financial inclusion, and discern emerging Market Trends for a robust and equitable financial future.

Note: The information provided in this article is for informational purposes only and should not be construed as financial advice. As with any investment, it is essential to conduct thorough research and seek professional guidance before making any investment decisions.