The world of cryptocurrency has witnessed a remarkable evolution, with Bitcoin, the brainchild of Satoshi Nakamoto, leading the charge as the premier digital currency. However, the Bitcoin mainnet has also seen the emergence of various token standards, each vying for a share of the blockchain’s bandwidth. Among these, the recent introduction of Bitcoin Runes, also known as Runes BTC, has caused a significant stir, as it has effectively dethroned the long-standing BRC-20 blockchain and Ordinals standards in terms of on-chain activity.

In this comprehensive article, we delve into the rise of Rune token, its impact on the Bitcoin ecosystem, and the implications for the future of decentralized finance (DeFi) built on the world’s leading cryptocurrency.

Related Reading: Understanding Runes Protocol: Bitcoin Runes and why Devs Are So Excited By It

The Bandwidth War: Bitcoin Runes vs. BRC-20 vs. Ordinals

The Bitcoin protocol has seen a surge in activity in recent years, with various token standards competing for a share of the blockchain’s limited resources. BRC crypto, launched in February 2023, was developed to create a standard for fungible Bitcoin tokens on the Bitcoin mainnet, offering affordability, speed, and increased accessibility compared to its predecessor, Ordinals. Ordinals, introduced in January 2023, enabled the creation of NFT-like “inscriptions” on the Bitcoin blockchain, raising the question: is Bitcoin NFT?

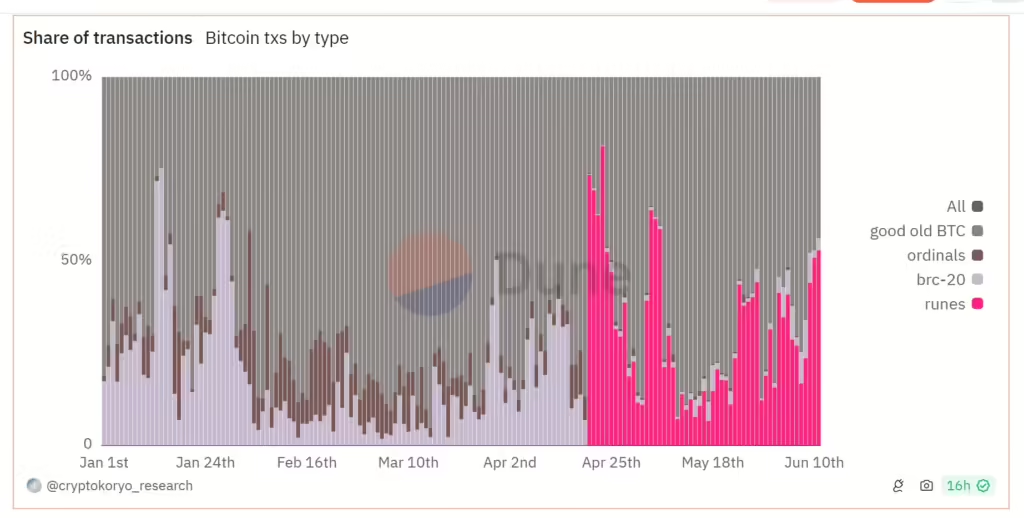

However, the arrival of Rune coin in April 2024 has shifted the landscape significantly. According to on-chain data, Runes protocol has been recording an average of at least 150,000 daily transactions since its debut, effectively dethroning BRC-20 tokens and Ordinals. The highest single-day transaction count for Runes was a staggering 753,584 on April 23.

The blockchain network is predominantly occupied by Bitcoin on most days. However, amidst the bandwidth rivalry among the Bitcoin standards – Ordinals, BRC-20, and Runes, a clear victor has emerged.

The onchain activity serves as a reliable gauge of real-time market demand and the collective interest of the community. Since its introduction on April 20, Runes, a standard designed for generating interchangeable tokens on the Bitcoin platform, has surpassed the established Ordinals and BRC-20 standards in terms of transaction share.

The Efficiency Advantage: Runes vs. BRC-20

The primary advantage of Runes over BRC-20 lies in its increased efficiency in creating fungible tokens on the Bitcoin network. Runes enables off-chain transactions, thereby reducing congestion on the Bitcoin mainnet and facilitating more transactions to be processed quickly and cost-effectively. This translates to faster confirmation times and lower transaction fees for users, making Bitcoin transactions more accessible and practical for everyday use.

In contrast, creating and transferring BRC-20 tokens can be a complex process, often requiring more space on the blockchain. This complexity has led to complaints that BRC crypto and Ordinals clog up the network and cause fee increases, making them less attractive for widespread adoption.

The Surge in Runes Transactions

The growth in Runes transactions has been nothing short of remarkable. On June 10 and 11, 2024, Runes accounted for 51% and 53% of the total Bitcoin network bandwidth, respectively. This surge in activity indicates a strong and sustained interest from investors and users in the Runes ecosystem.

In comparison, BRC-20’s transaction share peaked at over 50% on March 30, 2024, but has since struggled to maintain its dominance, falling behind Runes and the core Bitcoin protocol.

The Impact on Bitcoin Mining

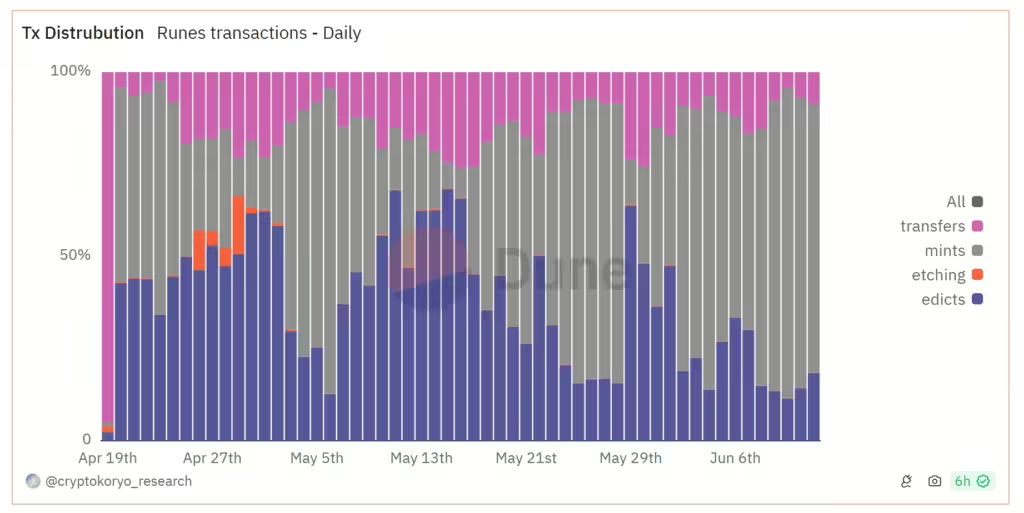

The increase in network activity driven by Runes has had a positive impact on Bitcoin miners. Since its launch, Runes have generated nearly 2,500 BTC, approximately $170 million in market value, in the form of fees for mining, etching, and edicts.

The spike in total Bitcoin transactions on April 23, 2024, when the network processed over 1.6 million unique transactions, was largely attributed to the launch of Runes. This surge in activity has helped Bitcoin miners maintain their monthly revenues, further solidifying the Runes protocol’s importance within the Bitcoin ecosystem.

The rise of Runes has not only disrupted the existing token standards but also paves the way for the next phase of Bitcoin’s evolution. Runes, along with BRC-20 and Ordinals, are seen as stepping stones towards the development of more sophisticated decentralized finance (DeFi) applications on the Bitcoin network.

By enabling the creation of fungible tokens, Runes has expanded the possibilities for building complex financial instruments and smart contracts on top of the Bitcoin blockchain. This, in turn, can lead to the emergence of a thriving DeFi ecosystem within the Bitcoin network, further enhancing its utility and attracting a wider range of investors and developers.

Runes: Draining Liquidity from Altcoins?

The success of Runes has not gone unnoticed by the broader cryptocurrency community. Casey Rodarmor, the creator of Bitcoin Ordinals and Runes, has suggested that if Runes are successful, they may “drain liquidity, technology, and attention away from other cryptocurrencies, and bring it back to Bitcoin.”

This potential shift in focus and resources towards the Bitcoin network could have significant implications for the altcoin market. As more attention and investment flow into the Bitcoin ecosystem, it may lead to a relative decline in the prominence and valuation of other cryptocurrencies, potentially reshaping the overall crypto landscape.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.