The cryptocurrency industry, already under scrutiny for cryptocurrency money laundering and other unlawful activities, faces renewed attention with the case of Alexander Vinnik. This Russian national has pleaded guilty to a massive $9 billion crypto laundering conspiracy linked to the defunct BTC-e exchange, highlighting the complex challenges regulators encounter in policing digital assets. This case, emblematic of the broader issues of cybercrime and criminal misuse within the sector, underscores the urgent need for stringent regulations to combat money laundering in the decentralized realm of cryptocurrencies.

Read the Full Press Release by US Department of Justice, Office of Public Affairs

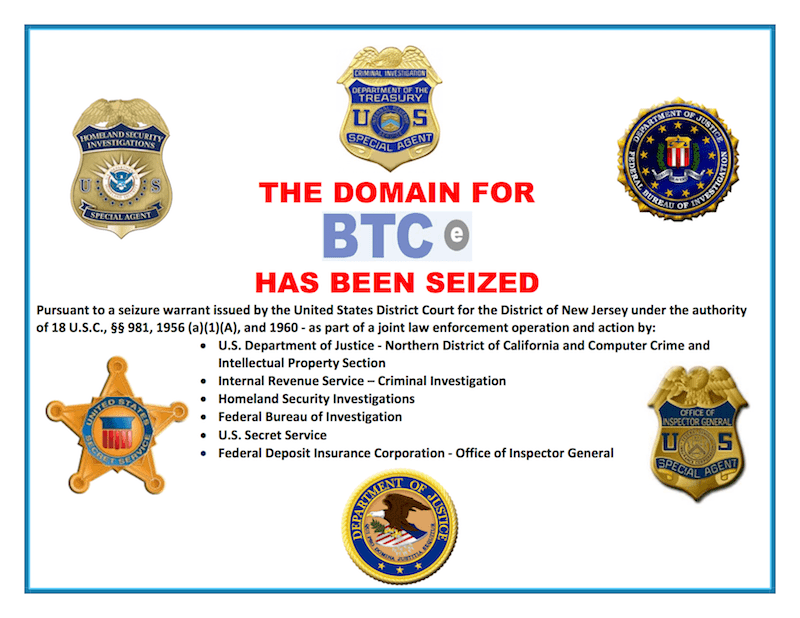

The Birth and Demise of BTC-e

BTC-e was founded in July 2011 primarily serving the russian maerket, with servers in the USA and by 2015 taken over by Russian oligarch named Konstantin Malofeev. The exchange had headquater in London, UK and owned by a firm called ALWAYS EFFICIENT LLP. US Justice Department closed down the exchange on 26th July, 2017, after they charged BTC-e and Vinnik for International money laundering case and allegedly laundering funds from the hack of Mt. Gox. Moreover BTC-e was also believed to be involved in funding the war in Donbass in 2014.

From 2011 to 2017, BTC-e was a pivotal exchange in the cryptocurrency world, handling transactions worth over $9 billion and attracting a global user base, including many from the United States. Under Vinnik’s leadership, it became infamous as a nexus for money laundering, with criminal proceeds from hacking, ransomware, and drug trafficking being laundered through the platform. This scandal underscores the critical need for exchanges to implement robust anti-money laundering measures.

Vinnik’s Guilty Plea and the Extent of the Conspiracy

In a significant development, Vinnik has admitted guilt to conspiring in money laundering, marking a pivotal moment in the legal proceedings. The Department of Justice has laid bare the extent of the money laundering conspiracy, revealing how Vinnik and associates utilized shell companies worldwide to launder funds via BTC-e. This operation, resulting in over $121 million in losses, highlights the vast scale and complexity of criminal activities in the cryptocurrency space.

“Today’s result shows how the Justice Department, working with international partners, reaches across the globe to combat cryptocrime, This guilty plea reflects the Department’s ongoing commitment to use all tools to fight money laundering, police crypto markets, and recover restitution for victims.”

Deputy Attorney General Lisa Monaco

BTC-e’s Regulatory Failings

The investigation into BTC-e unveiled a blatant disregard for compliance with financial regulations, lacking registration with the Financial Crimes Enforcement Network (FinCEN) and missing crucial anti-money laundering (AML) and ‘know-your-customer’ (KYC) protocols. This negligence positioned BTC-e as an attractive platform for those wishing to hide their financial dealings, exacerbating its role in facilitating unlawful activities.

Global Efforts to Combat Crypto Laundering

The crackdown on BTC-e and Vinnik by FinCEN in 2017, for breaches of U.S. AML laws, is part of a global initiative to curb cryptocurrency-enabled money laundering. This action, along with the Financial Conduct Authority (FCA) in the UK expanding its oversight of the cryptocurrency market, signals a concerted effort by regulatory bodies to address the risks of money laundering within the sector.

The Extradition Saga

After a complex extradition process involving Greece, the U.S., Russia, and France, Vinnik’s guilty plea marks the end of a long legal journey. Initially detained in Greece, the battle over his extradition saw various countries stake their claim before France secured his transfer, leading to a five-year prison sentence. This saga underscores the international dimensions of regulating cryptocurrency-related crimes.

The Impact on the Crypto Ecosystem

This case highlights the pressing need for robust regulatory frameworks in the cryptocurrency industry to address vulnerabilities and prevent financial crimes like fraud and money laundering. As the sector evolves, global policymakers and law enforcement are intensifying their efforts to safeguard against these risks, sending a clear message that illicit activities will not go unchecked.

Tightening Regulations and the Future of Crypto

Increasing regulatory scrutiny and enforcement actions, as seen in the Vinnik case, reflect a broader trend towards tighter control over the cryptocurrency market. Agencies such as FinCEN and the FCA are focusing on stringent AML strategies and compliance to enhance the financial system’s security and integrity, aiming for a transparent and accountable digital asset ecosystem.

Alexander Vinnik’s Sentencing and Potential Consequences

While Vinnik awaits sentencing, the outcome of his case will have significant implications for the cryptocurrency industry, setting a precedent for the legal consequences of engaging in illicit activities. This case, overseen by the Department of Justice, will likely influence future regulatory and enforcement strategies against money laundering conspiracy within the digital asset space.

The Ongoing Battle Against Crypto-Enabled Crimes

The resolution of the Vinnik case marks a critical milestone in the ongoing battle against cryptocurrency-related financial crimes. It serves as a warning to those involved in criminal activities, emphasizing the global commitment of regulators and law enforcement to uphold the integrity of the financial system and adapt to the evolving challenges of the cryptocurrency industry.

Lessons Learned and the Path Forward

The downfall of BTC-e and the prosecution of Vinnik offer valuable lessons for the cryptocurrency industry, emphasizing the necessity of stringent regulations, comprehensive compliance measures including AML and KYC protocols, and the need for greater transparency and accountability within the digital asset ecosystem. As the cryptocurrency market evolves, it’s crucial for both regulators and industry participants to collaborate effectively to mitigate the risks of money laundering and other financial crimes, ensuring the potential of cryptocurrencies is realized in a secure and responsible manner.

The Broader Implications for Crypto Regulation

The Vinnik case is not an isolated incident but signifies a broader trend of increased regulatory scrutiny and enforcement actions by authorities, including the Department of Justice, targeting the cryptocurrency sector. As governments and financial bodies globally acknowledge the potential risks associated with digital assets, they are intensifying their efforts to establish and enforce comprehensive regulations. This move towards stricter regulatory oversight is poised to significantly influence the industry, shaping the future of cryptocurrency adoption and usage.

Conclusion: A Cautionary Tale and a Call to Action

The case of Vinnik and the BTC-e exchange serves as a stark warning against the misuse of the anonymity and decentralization features of cryptocurrencies for illicit activities. It highlights the global authorities’ commitment to combating financial crimes in the digital asset space and the increasing acknowledgment that the industry requires robust regulatory oversight. As the cryptocurrency ecosystem evolves, it’s essential for all stakeholders, including industry players and policymakers, to collaborate in creating a more transparent, secure, and accountable digital financial landscape. This collaborative effort is key to unlocking the full potential of this transformative technology while minimizing the risks of fraud and money laundering.

Table of Contents

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are subject to market risks, and readers should do their own research and consult with professionals before making any investment decisions. Hash Herald is not responsible for any losses in the market.