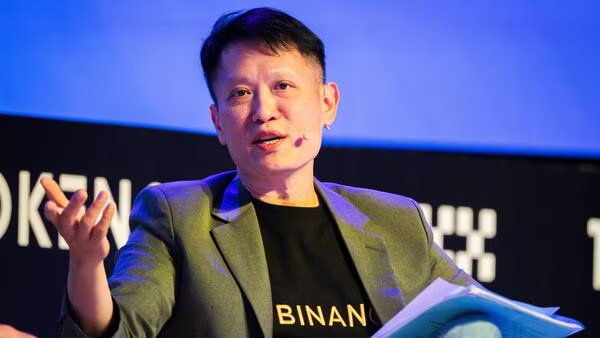

The cryptocurrency market has been abuzz with anticipation and speculation, with industry leaders like Binance CEO Richard Teng offering their insights and bitcoin predictions on the future trajectory of digital assets. In a recent development, Teng has made a bold forecast for the world’s largest cryptocurrency Binance, Bitcoin (BTC). Teng’s bullish outlook on Bitcoin’s price predictions has garnered significant attention within the crypto market, as he foresees the asset reaching new heights in the coming years amidst a potential bitcoin rally.

Teng’s 2024 Bitcoin Price Prediction: $80,000 and Beyond

In a recent interview on the Bankless YouTube channel, Teng shared his bitcoin price projections for the coming years. Initially, he had predicted that Bitcoin would reach an all-time high of $80,000 by the end of 2023, a bitcoin end of year prediction. However, with the recent approval and launch of Spot Bitcoin ETFs in the United States, Teng has revised his btc price prediction, now anticipating that Bitcoin will surpass the $80,000 mark before the end of the current year, reaching bitcoin its highest level year.

Teng’s optimism is fueled by the significant influx of capital into the crypto market following the introduction of Spot Bitcoin ETFs. The Binance CEO believes that the approval and launch of these investment vehicles have opened the doors for traditional financial institutions, such as family offices and endowment funds, to increase their exposure to Bitcoin, driving up demand and crypto prices.

Bullish Outlook for 2025: Teng Sees Continued Upward Momentum

Looking beyond 2024, Teng’s Bitcoin price predition become even more impressive. The Binance CEO Richard Teng is particularly bullish on the year 2025, anticipating that it will be an “incredibly bullish” year for the cryptocurrency industry. Teng cites several key factors that he believes will drive Bitcoin’s growth, including improvements in macroeconomic conditions and a more favorable regulatory environment for the crypto market.

Notably, Teng has expressed confidence in the potential for the Federal Reserve (Fed) to cut interest rates before the end of 2024. This move, he believes, could provide a significant boost to the crypto market, as lower interest rates typically stimulate investment and economic activity. Additionally, the anticipated approval and launch of Ethereum Spot ETFs are expected to further enhance the influx of institutional capital into the digital asset ecosystem.

Teng’s Revised Outlook: Surpassing Previous Predictions

Teng’s previous price predictions for bitcoin were based on the cryptocurrency’s historical trends following each Bitcoin halving event. However, he acknowledged that he had underestimated the impact of the Bitcoin Spot ETF launch and the subsequent billions of dollars flowing into the market as Bitcoin ETF inflows.

Consequently, Teng has revised his bitcoin price target upward, stating that Bitcoin’s price will surge significantly higher than his initial base prediction from the end of last year. While the Binance CEO refrained from providing an exact price predition, he highlighted the bullish forecast made by Standard Chartered earlier this year, which projected Bitcoin potentially reaching as high as $250,000 by 2025, far exceeding what is target bitcoin of $80,000.

Spot ETFs: A Game-Changer for Bitcoin’s Institutional Adoption

Teng’s optimistic outlook is largely driven by the transformative impact of Spot Bitcoin ETFs. These investment vehicles have proven to be a game-changer for the cryptocurrency industry, as they have lowered the barriers to entry for institutional investors and provided a more accessible and regulated avenue for exposure to Bitcoin.

The Binance CEO believes that the approval and launch of Spot Bitcoin ETFs have catalyzed a significant influx of capital from traditional financial institutions, such as family offices and endowment funds. These institutional investors, who have traditionally been hesitant to enter the cryptocurrency market directly, now have a more familiar and regulated investment product through which they can gain exposure to Bitcoin, expanding crypto user pools.

Divergent Investor Behavior: Bitcoin vs. Ethereum

While Teng’s outlook on the crypto market remains overwhelmingly positive, he has observed some divergent investor behavior between Bitcoin and Ethereum. According to the Binance CEO, the recent sell-off in the Bitcoin market has been primarily driven by long-term holders and whales, who are adjusting their positions amid the market’s consolidation phase.

This trend is evidenced by the Hodler Net Position Change metric, which has consistently shown negative values, indicating that these significant players are moving their Bitcoin holdings to crypto exchanges, potentially to sell and exert downward pressure on crypto prices.

In contrast, Teng notes that Ethereum wallets have continued to increase, suggesting a more bullish investor sentiment surrounding the second-largest cryptocurrency. This divergence in investor behavior between the two leading digital assets highlights the nuanced dynamics within the crypto market, where different segments of the investor base may exhibit varying levels of confidence and risk appetite.

The Importance of Macroeconomic Factors

Teng’s bullish bitcoin predictions for the cryptocurrency market extend beyond just the technical and regulatory crypto market factors. The Binance CEO also emphasizes the significance of macroeconomic conditions in shaping the future trajectory of digital assets.

Teng believes that improvements in macroeconomic crypto market drivers, such as a more favorable interest rate environment and a generally stable economic climate, will be crucial for the continued growth and adoption of cryptocurrencies. By fostering a conducive macroeconomic landscape, these broader economic factors can create a more favorable environment for the crypto market to thrive and attract further institutional crypto investment.

The Cyclical Nature of Crypto Rallies: Lessons from Past Cycles

In his crypto market analysis, Teng has also drawn insights from the historical performance of Bitcoin and the broader cryptocurrency market. He notes that in previous crypto cycles, the pattern typically involved Bitcoin rallying first, followed by the subsequent rise of other major cryptocurrencies and then the eventual surge of altcoins.

However, Teng observes that the current cycle has exhibited a unique characteristic, where the meme coins have jumped straight to the forefront, even before the broader market has had a chance to rally. This observation highlights the evolving dynamics within the crypto market, where the market’s behavior may not always adhere to the patterns seen in the past.

Navigating Market Volatility: Teng’s Perspective

While Teng remains overwhelmingly bullish on the future of cryptocurrencies, he acknowledges the inherent crypto volatility that characterizes the digital asset market. The Binance CEO emphasizes that the path to new highs will not be a “straight line,” and investors should expect the typical ups and downs that are characteristic of the crypto market.

Teng believes that these periods of market volatility can actually be beneficial for the long-term health and development of the cryptocurrency industry. The ups and downs, he argues, allow for a natural consolidation and maturation of the market, ultimately strengthening the foundations for future growth.

Cautious Optimism: Balancing Risks and Opportunities

Despite his bullish outlook, Teng maintains a stance of cautious optimism when it comes to the crypto market. While he is confident in the long-term potential of digital assets, he acknowledges the risks and uncertainties that still exist within the industry, such as evolving crypto regulations.

The Binance CEO emphasizes the importance of investors conducting thorough research, diversifying their portfolios, and exercising prudent risk management practices. By striking a balance between embracing the opportunities presented by the crypto market and managing the inherent risks, investors can position themselves to navigate the volatile landscape more effectively.

Conclusion: Teng’s Vision for the Crypto Industry’s Future

Binance CEO Richard Teng’s bullish bitcoin predictions and the broader cryptocurrency market have generated significant buzz within the industry. Teng’s confidence in the transformative impact of Spot Bitcoin and Ethereum Spot ETFs, coupled with his optimistic outlook on macroeconomic crypto market factors and the industry’s long-term potential, paints a compelling picture of the cryptocurrency market’s future.

As the digital asset ecosystem continues to evolve and attract greater institutional participation, Teng’s insights provide valuable guidance for investors and industry stakeholders alike. By closely monitoring the crypto market performance, regulatory developments, and broader economic crypto market trends, the Binance CEO’s forecasts offer a glimpse into the exciting possibilities that lie ahead for the cryptocurrency industry.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.