The crypto scene in Canada has seen ups and downs , with big players like Gemini, OKX, dYdX, Paxos, Bybit, and Binance saying goodbye to the market. These companies are leaving because the Canadian Securities Administrators (CSA) has tightened the rules for crypto trading platforms making it tough for them to do business. This news from Canada has caused a stir in the world of crypto exchanges.

Gemini Leaves Canada

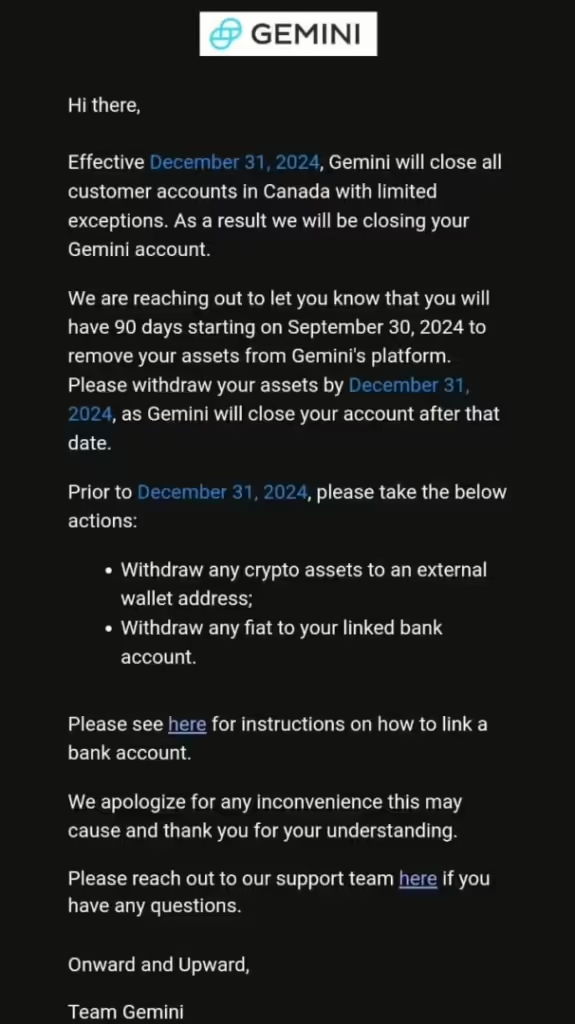

In an unexpected move, Gemini, the crypto exchange run by the Winklevoss twins, has said it will shut down all customer accounts in Canada by December 31, 2024. Many people think Gemini is one of the top crypto exchange platforms. The exchange is giving its Canadian users 90 days starting on September 30, 2024, to take their assets off the platform. This deadline to withdraw marks Gemini’s exit from the market and the start of account closures and asset removal for its Canadian customers.

Read More: US Bitcoin ETFs Rake in $1.1 Billion in Biggest Week Since Mid-July

Reasons Behind Gemini’s Decision

Gemini decided to close its Canadian operations after the CSA set a firm deadline for crypto trading platforms in the country to comply. The Canadian Investment Regulatory Organization (CIRO) has put in place tough membership rules to make sure regulations are followed and customers are protected.

Also, in 2022, the CSA made it harder to register crypto exchanges. They now have to sign binding agreements before they can register. The CSA also says platforms can’t “let clients buy or deposit value-referenced crypto assets (often called stablecoins),” which means there are now limits on stablecoins.

Gemini’s Response to the Regulations

Gemini wasted no time in responding to the new rules. It filed its pre-registration on April 13th. A company rep stressed that Canada was “one of the most important and developed markets in the Americas” and had an “essential role in Gemini’s international growth.” It’s worth noting that several days have passed since Gemini submitted its paperwork on April 13.

Yet even though Gemini tried to follow the rules, the company ended up closing shop in Canada. They blamed the tough regulatory scene for this decision.

Read More: Bybit Gets Full Crypto License in Kazakhstan: Big Move into CSIS Area

Big Crypto Exchanges Leave Canada

Gemini isn’t alone in leaving the Canadian market. Other big crypto platforms, like OKX, dYdX, Paxos, Bybit, and Binance, have also decided to exit the country. The downfall of FTX, Celsius Network, and Voyager Digital has rattled people’s trust in the crypto world making it harder for exchanges to deal with regulations.

Binance’s Exit from Canada

Binance one of the biggest crypto exchanges worldwide, left Canada last year because of new rules about stablecoins and limits for investors. The company said it became clear there were no “good ways to protect our Canadian users.”

Bybit’s Departure from Canada

Bybit, a major crypto exchange, left the Canadian market in June 2023. It cited Canada’s increasing regulatory oversight as the reason.

Regulatory Challenges in Canada

The Canadian crypto market has faced many regulatory hurdles that have caused big exchanges to leave. The CSA has tightened compliance rules for crypto trading platforms. This includes pre-registration undertakings and limits on stablecoins. These changes have made it tough for these companies to do business.

Provincial and Federal Regulations

Making things more complex, some Canadian provinces have their own rules for crypto assets. This means Canadians must know both provincial and federal guidelines when they deal with crypto.

Lack of Stablecoin Regulation

Canada still lacks a clear set of rules for stablecoins, which play a key role in the crypto world. This absence of regulations adds to the hurdles crypto exchanges face when they operate in the country.

Investor Protection Concerns

The CSA stresses the need to protect investors in the crypto market. It warns investors about the risks tied to these assets, which can change value , unlike regular money. Many investors worry about their ability to take out their money when they need it.

CSA’s Efforts to Educate Investors

To tackle these issues, the CSA has expanded its investor tools crypto assets page with more details and guides. This is part of its work to align policies across Canada’s financial markets.

Impact on Canadian Crypto Investors

The exit of big crypto exchanges from Canada will shake up Canadian crypto investors. Gemini’s shutdown means users have a short time to take out their assets, which could lead to trouble and hassle. The deadline of 90 days from April 10 for Gemini’s pre-registration shows how fast things are changing in the Canadian crypto scene.

Why It’s Smart to Spread Out Your Crypto

This event shows why Canadian crypto investors should spread their assets across different exchanges and keep their private keys safe by storing their assets in wallets they control. Investors should also keep up with the latest crypto news to make smart choices about their bitcoin and other cryptocurrency investments.

Potential Opportunities for Smaller Exchanges

The departure of big crypto exchanges from Canada might open doors for smaller, nimbler platforms to step in and meet the needs of Canadian crypto investors. These platforms could have an easier time dealing with the rules and offer a more customized service to their clients.

Importance of Regulatory Compliance

Yet, any new or current crypto exchange doing business in Canada will have to follow the CSA’s rules to avoid the same fate as the leaving giants.

Conclusion

The crypto market in Canada has run into big problems. Major exchanges like Gemini, OKX, dYdX, Paxos, Bybit, and Binance have all said they’re leaving the country. They’re pulling out because the CSA has tightened the rules for crypto trading platforms. This has created a tricky situation for these companies to work in.

As Canada’s crypto market keeps changing, investors and exchanges will need to deal with the rules. They’ll need to focus on following regulations and protecting investors. The big players leaving might create chances for smaller more flexible platforms. But these newcomers will have to show they’re serious about following the rules to do well in Canada’s crypto world.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.