Hackers and attacks have increased in the crypto world in recent years, with DeFi platforms becoming a favorite for bad guys. The OnyxDAO hack is the latest example. OnyxDAO, a well-known decentralized protocol lost about $3.2 million to a clever attack. This event highlights the ongoing struggle to keep DeFi safe and reliable. Developers and users alike are trying to navigate the changing world of crypto protocols and financial services.

Understanding the OnyxDAO Hack

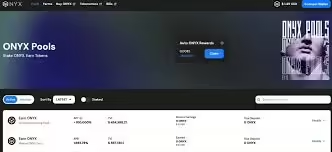

PeckShield, a blockchain security company, traced the OnyxDAO exploit to a precision issue in the CompoundV2 vulnerability. Hackers used this flaw to change exchange rates and steal a large amount of user assets. They took 4.1 million VUSD, 7.35 million XCN, 5,000 DAI, 230 WBTC, and 50,000 USDT causing a $3.8 million loss. The hacker’s wallet now has 521 ETH worth $1.36 million. Blockchain forensics and transaction analysis helped find the cause of the Onyx Protocol attack.

Related Read: Bedrock DeFi Hit by $2 Million Exploit: uniBTC Contract hit

Weak Spots in Decentralized Finance

The OnyxDAO incident serves as a clear warning about the growing safety concerns in DeFi systems. As these distributed networks become more popular and draw in more money, they have also turned into prime targets for bad actors looking to take advantage of even tiny flaws in their core code. This problem gets worse because DeFi is complex and changes fast, which can make it hard for coders to see and fix all possible safety issues in DeFi platforms.

Government Actions and Close Looks

The rise in hacking and security breaches in the crypto market has caught the eye of regulators worldwide, who are stepping up their game to tackle these issues and boost investor protection. In the US, the Securities and Exchange Commission (SEC) has been quite busy going after crypto-related companies slapping them with lawsuits and tighter rules. This close watch by regulators aims to protect investors, but it’s also sparked some heated talks in the crypto world about how it might slow down new ideas and the growth of the crypto industry as a whole.

Cutting Down Risks and Beefing Up Security

As the OnyxDAO exploit and other similar events show, DeFi needs stronger safety measures and full DeFi risk management plans more than ever. Cryptocurrency protocols and platforms must make it a top priority to carry out thorough blockchain security audits, set up bug bounty programs, and keep watch all the time to spot and fix weak points before someone can take advantage of them. Also, using cutting-edge safety tech, like wallets that need more than one signature and systems that manage keys in a spread-out way, can boost the toughness of DeFi protocols and make crypto wallet protection better.

The Role of Blockchain Analytics and Forensics

After the Onyx Protocol attack, blockchain forensics and analytics have become essential. Companies like PeckShield, which focuses on blockchain security and on-chain data analysis, have a key role in tracking stolen money and finding the criminals. These tools help recover crypto assets and offer useful information to create stronger security systems and rules, improving cryptocurrency fraud detection and theft detection.

Educating Users and Promoting Awareness

Along with tech fixes, the crypto world needs to teach users and boost security know-how. People who invest and take part in DeFi must learn to spot dangers like phishing scams, rug pulls, and other shady stuff. By giving users this info, the field can build a smarter more alert group. This group will be better able to handle the tricky parts of the crypto scene and lower crypto hacking risks.

The Changing World of Crypto Rules

The OnyxDAO exploit and other similar events have put a spotlight on the changing scene of cryptocurrency rules. As authorities worldwide try to balance encouraging new ideas and safeguarding investors, the crypto world finds itself dealing with an ever more tricky set of regulations. This shifting environment has sparked ongoing talks and debates about the right way to regulate, with some pushing for more focused and subtle policies, while others call for a tougher approach to make sure blockchain compliance monitoring happens.

How This Affects What Investors Think and Big Companies Getting Involved

The recent jump in hacking events and security breaches has an impact on investor feelings and slows down how fast big players adopt the crypto market. When major incidents like the OnyxDAO exploit damage trust in DeFi platforms’ safety and dependability, some investors might be more careful about putting money into crypto. This could spread to other parts of the industry reducing the flow of big money and holding back the overall growth and wider use of cryptocurrencies.

Working Together and Group Action

Tackling the security issues in the cryptocurrency world needs everyone to pitch in – developers, researchers, regulators, and users alike. When people team up and share what they know, they can spot and fix weak points, create stronger security measures, and set up good practices for the whole industry. This teamwork is key to build a DeFi system that’s more secure and can bounce back from threats that keep changing, like bridge hacks and exchange rate manipulation.

The Changing Face of Decentralized Protocols

Despite the security issues shown by the OnyxDAO hack, decentralized protocols still play a key role in the crypto world. These systems have clear benefits, like more openness less risk from other parties, and the chance to include more people in finance. As crypto grows, decentralized protocols will become even more important. This means we need to work together to fix the decentralized finance weak spots that have caused problems in this field.

Conclusion

The OnyxDAO exploit serves as a stark warning about the ongoing security issues in the cryptocurrency world in decentralized finance. As bad actors keep targeting smart contract weaknesses in DeFi protocols, we need strong security measures more openness, and team efforts now more than ever. By tackling these problems head-on, the crypto community can help bring back investor trust, get more big players involved, and create a safer tougher DeFi system.

Things like checking blockchain weak spots testing for holes making decentralized exchanges safer, and looking into DeFi insurance options will be key to lowering the risks of turning real-world assets into tokens and making sure DeFi lasts long-term. As this field grows up, everyone involved needs to stay alert, take action, and work on dealing with new security threats keeping user money safe, and helping the crypto world grow .

FAQ

What is the OnyxDAO hack and its impact?

The OnyxDAO hack resulted in a $3.2 million loss due to a flaw in the CompoundV2 vulnerability, highlighting the ongoing challenges in ensuring the safety and reliability of DeFi protocols.

How did the OnyxDAO exploit occur?

The exploit was traced back to a precision flaw in the CompoundV2 vulnerability, which allowed attackers to manipulate exchange rates and siphon off a significant amount of user assets, resulting in a $3.8 million loss.

What are the vulnerabilities in Decentralized Finance?

The OnyxDAO incident underscores the increasing security risks inherent in DeFi platforms, as they become prime targets for malicious actors seeking to exploit smart contract vulnerabilities in the rapidly evolving DeFi landscape.

How can the cryptocurrency community enhance security?

Robust security measures, comprehensive DeFi risk management strategies, blockchain security audits, and the adoption of advanced security technologies are essential to enhance the overall resilience of DeFi protocols and improve crypto wallet protection.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.