The world of cryptocurrency has been abuzz with the recent developments surrounding Chainlink (LINK), the leading decentralized oracle network. As Chainlink continues to unlock its non-circulating token supply, the market has been closely watching the potential impact on the Chainlink price. In this comprehensive article, we’ll delve into the details of the latest LINK token unlock, the implications for the LINK ecosystem, and explore the possibility of a LINK price crash to the $10 level.

Chainlink’s Token Unlock Schedule

Chainlink, like many other cryptocurrency projects, has a structured token unlock schedule that ensures a gradual release of its native token, LINK, into the market. This mechanism is designed to maintain a healthy balance between supply and demand, allowing the network to grow and evolve without causing significant Chainlink token price volatility.

Understanding the Token Unlock Process

The Chainlink team periodically unlocks a portion of its non-circulating LINK tokens, which are then made available for use within the ecosystem. These Chainlink unlock tokens typically occur at regular intervals, with the goal of gradually increasing the circulating supply and fostering broader adoption of the LINK token.

Recent Unlock: 21 Million LINK Tokens

In the latest development, Chainlink has unlocked a significant chunk of its non-circulating token supply. On June 21st, 2023, the network unlocked 21 million LINK tokens, valued at approximately $295 million at the time. This LINK token release represented a 3.57% increase in the circulating supply, which now stands at 600 million LINK tokens.

Destination of the Unlocked Tokens

The distribution of the unlocked LINK tokens has sparked considerable interest and speculation within the cryptocurrency community. According to reports from the blockchain analytics platform Spot On Chain, the majority of these tokens were sent to the Binance crypto exchange.

Tokens Sent to Binance

Out of the 21 million LINK tokens unlocked, a staggering 18.25 million LINK, worth around $264 million, were immediately transferred to Binance. This move has raised concerns among LINK holders, as such large-scale transfers of LINK tokens Binance are often seen as a precursor to potential sell-offs.

Tokens Sent to a Multisig Wallet

In addition to the Binance transfer, 2.25 million LINK tokens, valued at $31.3 million, were sent to a multisig wallet identified as 0xD50f. This wallet is currently holding over 6 million LINK tokens, further contributing to the growing non-circulating supply.

Potential Impact on LINK Price

The recent LINK token unlock and the subsequent transfer of a significant portion of the unlocked tokens to Binance have fueled concerns among LINK investors regarding the potential Chainlink token unlock impact on the asset’s price.

Historical Token Unlock Trends

It’s worth noting that Chainlink has a history of unlocking and selling LINK tokens, with a total of 127 million LINK unlocked and 107.7 million deposited to Binance since August 2022. Interestingly, during these previous Chainlink unlock events, the Chainlink price has not always experienced a significant decline, with some instances even leading to eventual price spikes.

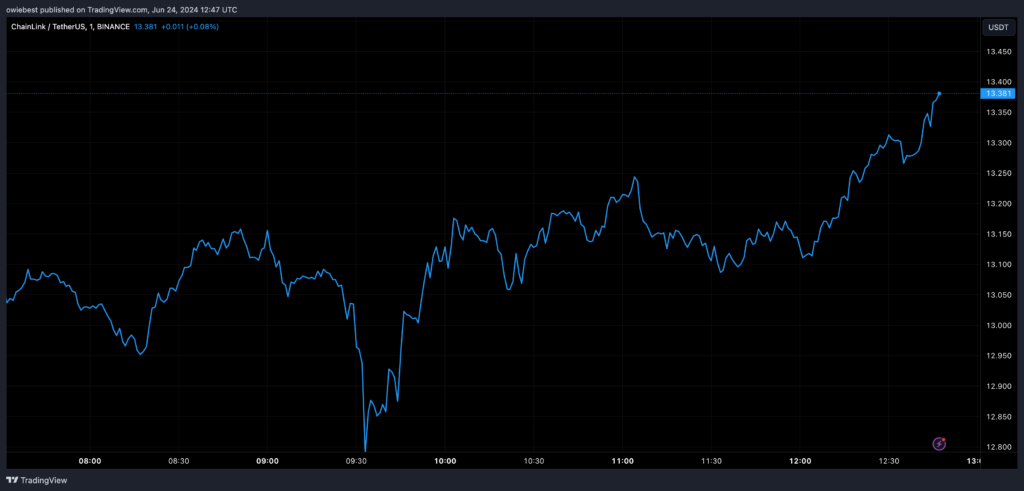

Current Market Conditions

However, the current market conditions may play a crucial role in determining the outcome of this latest unlock. The cryptocurrency market, in general, has been experiencing a downturn, with LINK itself experiencing an 8% decline in the past seven days. This broader market decline sentiment could potentially exacerbate the LINK token unlock effect, leading to a more pronounced Chainlink price drop.

Potential for a $10 LINK Price

Given the recent unlock and the transfer of a substantial portion of the unlocked tokens to Binance, there are concerns that the Chainlink token price could potentially crash to the $10 level. This speculation is based on several factors:

Support at the $10 Level

The $10 support price point is currently acting as a key psychological support for LINK. If this level is breached, it could trigger stop losses and intensify the sell-off, potentially leading to a free fall in the asset’s price.

Wider Market Conditions

The ongoing market downturn and the general bearish sentiment surrounding cryptocurrencies could further exacerbate the selling pressure on LINK, making it more vulnerable to a significant Chainlink price decline.

Future Unlock Potential

It’s worth noting that Chainlink still has a substantial amount of non-circulating LINK tokens, with 391.5 million LINK (worth $5.4 billion) locked in 24 different contracts. The prospect of future unlocks and potential sell-offs could continue to weigh on the LINK token price, potentially pushing it towards the $10 level.

Chainlink’s Oracle Solutions and Institutional Adoption

While the recent token unlock and the potential price impact are significant concerns, it’s important to consider Chainlink’s broader ecosystem and its value proposition. Chainlink’s decentralized price Oracles network has been gaining traction in the cryptocurrency and TradFi sectors, positioning the project as a crucial infrastructure provider for the emerging real-world assets (RWA) narrative.

Institutional Interest in RWA

Prominent financial institutions, such as BlackRock and Franklin Templeton, have shown growing interest in the Tokenisation of Real World Assets. As this trend continues to gain momentum, the demand for Chainlink’s oracle services could potentially increase, providing a counterbalance to the selling pressure stemming from the token unlocks.

Chainlink’s Continued Growth

Despite the recent price fluctuations, Chainlink has demonstrated its ability to generate consistent demand and maintain its value proposition. The project’s year-over-year price growth of 127.6% is a testament to its resilience and the market’s continued confidence in its long-term potential.

Conclusion

The latest Chainlink token unlock, with a significant portion of the unlocked tokens being sent to Binance, has undoubtedly raised concerns among LINK investors. The potential for a Chainlink unlock price crash to the $10 level is a valid concern, given the current market conditions and the prospect of future unlocks.

However, it’s crucial to consider Chainlink’s broader ecosystem, its value proposition, and the growing institutional interest in the real-world assets narrative. While the short-term price volatility may persist, Chainlink’s long-term prospects remain promising, and the network’s ability to adapt and innovate could help it navigate these challenges and emerge stronger.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks, and readers should conduct their own research and consult with financial advisors before making investment decisions. Hash Herald is not responsible for any profits or losses in the process.