The world of Bitcoin mining has experienced a remarkable evolution with the introduction of Hashrate Futures, a groundbreaking new financial instrument. This collaborative innovation by Luxor Technology Corporation and Bitnomial Inc. represents a significant milestone in the cryptocurrency industry, making waves in crypto mining news and expanding bitcoin services.

Introducing Hashrate Futures: A Game-Changer for Bitcoin Mining

Trading under the ticker symbol $HUP, Hashrate Futures stand as the first-ever Bitcoin mining derivative product listed on a regulated exchange. Each contract, representing 1 petahash (PH) of computational power, introduces a unique opportunity for miners to hedge their revenue and for investors to speculate on the bitcoin future price, marking a significant moment in hashrate mining and btc futures.

Empowering Miners with Hedging Tools

With the launch of Hashrate Futures, Bitcoin miners now have a potent tool to hedge revenue and mitigate price risk, addressing the volatility that often characterizes their income. These contracts allow miners to secure their future earnings and stabilize their cash flows, offering a strategic advantage in planning and managing their operations.

Unlocking New Avenues for Investors

Hashrate Futures not only benefit miners but also open new investment avenues for a diverse group of market participants. Investors, hedge funds, and financial entities can now engage in hashrate trading and gain exposure to bitcoin live stock, tapping into the Bitcoin mining market and diversifying their investment portfolios.

The Luxor-Bitnomial Collaboration: A Synergistic Partnership

The development of Hashrate Futures is a testament to the strategic partnership between Luxor Technology Corporation and Bitnomial Inc., both of which are pioneers in the Bitcoin mining and derivatives sectors.

Luxor’s Expertise in Bitcoin Mining

Luxor, a leader in Bitcoin mining software and services, has been instrumental in the innovation within the industry. The company’s comprehensive understanding of the mining ecosystem and its creation of the Hashprice Index, a metric that quantifies the value of hashrate, have played a crucial role in the development of Hashrate Futures, showcasing Luxor’s bitcoin mining expertise and its range of luxor products.

Bitnomial’s Derivatives Expertise

Bitnomial, a Futures Commission Merchant regulated by the Commodity Futures Trading Commission, has utilized its expertise in crafting robust and compliant financial infrastructure to launch Hashrate Futures. The company’s portfolio, including Bitcoin Futures and Options, positions it as a formidable force in the US derivatives exchange and the broader crypto derivatives market.

The Mechanics of Hashrate Futures

Hashrate Futures are meticulously designed to offer a seamless and efficient trading experience for both miners and investors, highlighting the innovative approach taken in their development.

Contract Specifications

Each Hashrate Futures contract, representing 1 petahash (PH) of Bitcoin mining computational power with a monthly duration, is settled based on Luxor’s Bitcoin Hashprice Index. This reference rate is crucial in determining the value of the underlying hashrate, making it an essential tool for participants in the market, as indicated by the bitcoin hash rate chart and btc hashrate chart.

Fungibility with Bitcoin Futures

A standout feature of Hashrate Futures is their fungibility with Bitnomial’s existing Bitcoin Futures contracts. This allows traders to take positions in either USD or BTC, effectively separating hashrate risk from Bitcoin price risk and enhancing their trading strategies, a move that aligns with the evolving dynamics of bitcoin options chain and hashrates.

Counterparty Risk Mitigation

By leveraging Bitnomial’s federally regulated exchange and clearinghouse infrastructure, Hashrate Futures provide market participants with increased transparency and reduced counterparty risk compared to over-the-counter (OTC) hashrate derivative products. These exchange-traded derivatives represent a significant advancement in the market.

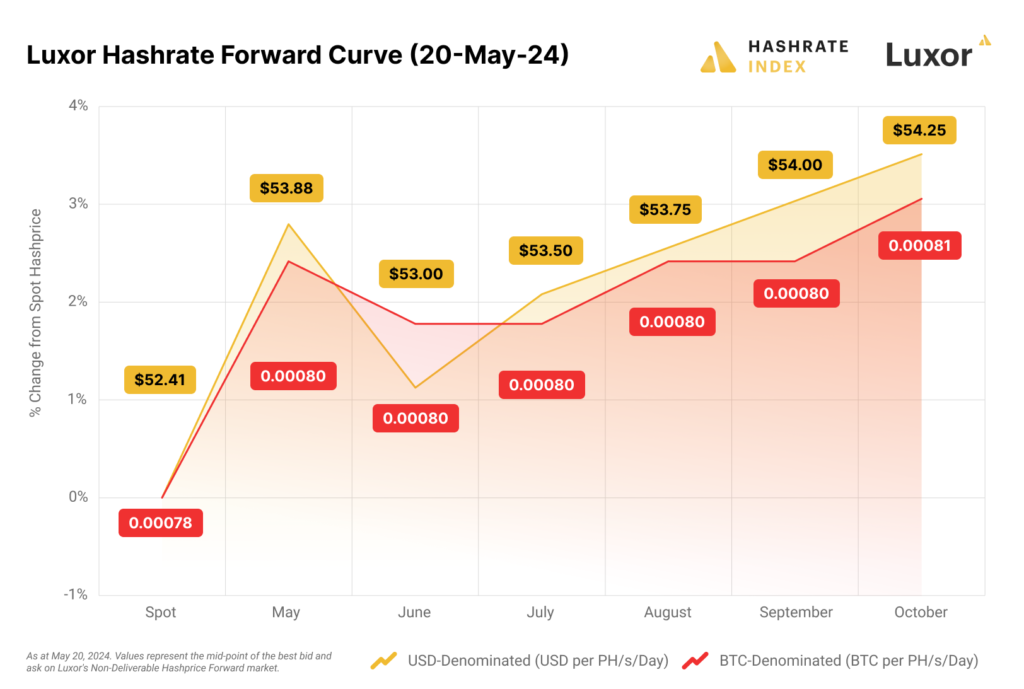

Hashrate Forwards: Luxor’s OTC Offering

In addition to the exchange-traded Hashrate Futures, Luxor also offers a suite of OTC hashrate derivative products, known as Hashrate Forwards. These contracts, available in both physically delivered and non-deliverable Hashrate Forwards (cash or BTC-settled) formats, cater to the specific needs of miners, market makers, and other industry participants, offering physically-backed contracts to ensure reliability and trust.

Hashrate Forwards: Flexibility and Customization

Hashrate Forwards offer a higher degree of customization, allowing market participants to tailor the contracts to their unique risk management requirements. This flexibility enables miners to hedge their revenue volatility, buy hashrate, or utilize the products as a financing tool, appealing to lenders concerned about the cost of capital.

Introducing Broker Services

To further support the adoption of its hashrate derivative offerings, Luxor, now operating as a luxor brokerage with regulatory approval from the CFTC to act as an Introducing Broker (IB), assists entities, such as Bitcoin miners, in accessing financial markets and addressing their execution and hedging needs.

The Impact of Hashrate Futures on the Bitcoin Mining Ecosystem

The introduction of Hashrate Futures is poised to have a significant impact on the Bitcoin mining industry, transforming the way miners and investors interact with the network’s computational power.

Enhancing Miner Revenue Stability

By providing miners with a regulated and transparent platform to hedge their revenue, Hashrate Futures can help stabilize their cash flows and enable more predictable long-term planning. This, in turn, can lead to increased investment and innovation in the mining sector, even as they navigate the challenges of difficulty adjustments.

Fostering Market Transparency

The exchange-traded nature of Hashrate Futures brings greater transparency to the Bitcoin mining market. The public availability of trading data, such as open interest, and the regulated nature of the contracts can help improve price discovery and facilitate more efficient risk management strategies.

Attracting Institutional Participation

The launch of Hashrate Futures is expected to attract increased institutional investment in the Bitcoin mining ecosystem, enhancing its liquidity and credit profile. As hedge funds, asset managers, and other financial entities gain exposure to the mining industry, it could lead to enhanced price stability and overall maturation of the crypto ecosystem.

The Future of Hashrate Derivatives

The introduction of Hashrate Futures marks a significant milestone in the evolution of the Bitcoin mining industry. As the market continues to evolve, we can expect to see further innovations and refinements in the hashrate derivatives space.

Expanding Derivative Offerings

Building on the success of Hashrate Futures, Luxor and Bitnomial may explore the development of additional derivative products, such as options and swaps, to provide even more comprehensive risk management tools for miners and investors. This could include expanding the Bitcoin derivatives complex with Bitcoin Futures volumes, physically-backed Bitcoin financial products, and the broader Bitcoin Product Complex, including physically delivered Bitcoin Futures and Deci Futures.

Enhancing Market Infrastructure

The growth of the hashrate derivatives market will likely drive the development of more robust market infrastructure, including improved data analytics, risk management tools, and regulatory frameworks. This, in turn, can foster greater participation and trust in the ecosystem.

Globalizing Hashrate Derivatives

While the current Hashrate Futures are focused on the US market, the potential exists for the expansion of these products to other jurisdictions, enabling global participation and further integration of the Bitcoin mining industry.

Conclusion: A New Era in Bitcoin Mining

The launch of Hashrate Futures by Luxor and Bitnomial represents a transformative moment in the Bitcoin mining industry. By providing miners and investors with a regulated and transparent platform to manage their hashrate-related risks and opportunities, alongside a live bitcoin price ticker, this innovation has the potential to reshape the dynamics of the entire ecosystem.

As the cryptocurrency market continues to evolve, the success of Hashrate Futures could pave the way for even more groundbreaking developments in the world of Bitcoin mining and derivatives trading. With the introduction of hashrate-bitcoin futures spreads, bitcoin-denominated hashrate exposure, mined bitcoin delivery, and transaction fees exposure, the future of this industry is undoubtedly bright. The Luxor-Bitnomial collaboration has positioned itself at the forefront of this exciting new frontier, potentially leveraging platforms like Ordinal Hub for enhanced transaction capabilities.

FAQs

1)What are Hashrate Futures and their significance?

Hashrate Futures are the first-ever Bitcoin mining derivative product listed on a regulated exchange, allowing miners to hedge revenue and investors to speculate on bitcoin’s future price.

2)How do Hashrate Futures benefit Bitcoin miners?

Hashrate Futures empower miners to hedge revenue, mitigate price risk, and stabilize cash flows, offering a strategic advantage in planning and managing their operations.

3)Who can benefit from Hashrate Futures?

Hashrate Futures benefit not only miners but also open new investment avenues for investors, hedge funds, and financial entities, diversifying their portfolios.

4)What is the impact of Hashrate Futures on the Bitcoin mining ecosystem?

Hashrate Futures enhance miner revenue stability, foster market transparency, and attract institutional participation, transforming the industry.

Table of Contents

Disclaimer: The information contained in this article is for informational purposes only. It should not be considered as financial or investment advice. The reader should do their own research before making any financial decisions based on the information provided above. Hash Herald is not responsible for any losses in market