Uniswap, a leading decentralized cryptocurrency exchange, recently faced a significant challenge as the U.S. Securities and Exchange Commission (SEC) issued a Wells notice, a pre-enforcement action indicating potential legal implications. This development, pivotal in the realm of crypto regulations and regulatory compliance, led to a notable dip in Uniswap’s native token, UNI. This article will explore the repercussions of the SEC’s actions on Uniswap, analyzing market reactions, investor sentiment, and the platform’s future amidst tightening securities oversight in the crypto industry.

Understanding the SEC Notice

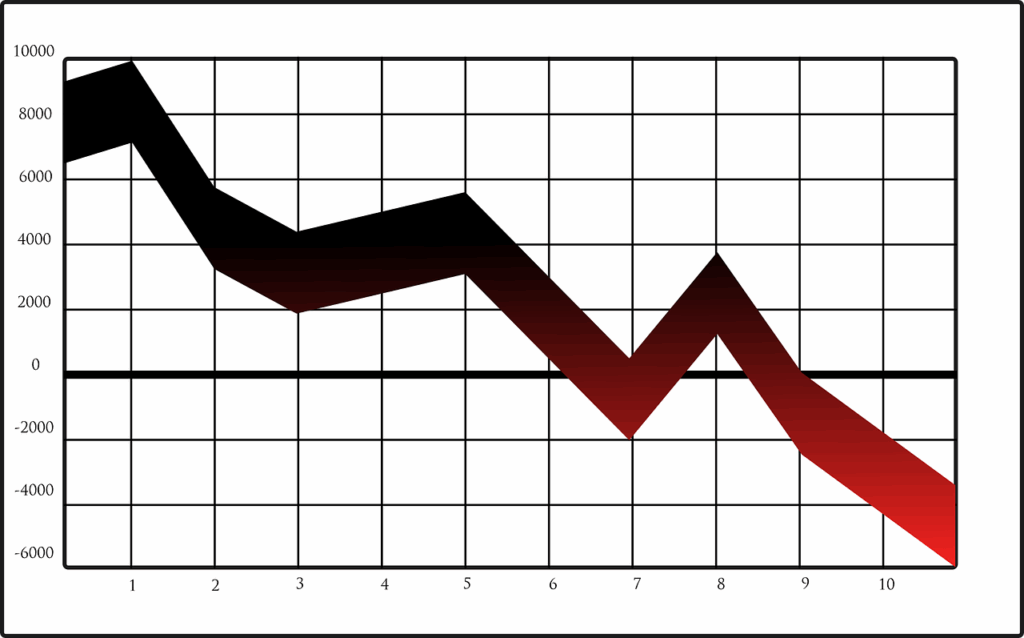

The cryptocurrency market felt immediate reverberations following the SEC’s Wells notice to Uniswap, triggering a sharp decline in UNI’s value. At the time of writing, UNI was trading at $9.37, marking a 16.2% fall in just 24 hours. This downturn is part of a broader trend of price fluctuations and trading volume shifts, reflecting a volatile week where UNI saw a 15% depreciation, a significant event in the crypto industry’s ongoing narrative of market trends.

The announcement of the SEC’s legal stance against Uniswap prompted a significant reaction within the crypto market, particularly among Uniswap’s largest investors. On-chain data revealed a surge in activity, with several whales adjusting their portfolios, offloading a substantial amount of UNI tokens. Notably, three whales acquired over 2 million UNI tokens from a Binance transfer in March 2023, a move possibly aimed at navigating the current regulatory uncertainty with strategic portfolio management and trading strategies.

Investor Reactions and Market Impact

on Pixabay

The SEC’s legal actions have raised concerns among Uniswap’s most significant investors, leading to rapid portfolio adjustments. This has seen a considerable amount of UNI tokens being moved to Binance, signaling a strategic response to the regulatory challenges facing the platform. This movement of funds by large-scale investors has prompted retail investors to reevaluate their positions, highlighting the interconnected nature of trading strategies and portfolio management within the crypto industry.

One investor, known as Wier flow outf, found themselves in a precarious position due to the market’s downturn, experiencing an impermanent loss. After purchasing 226,245 UNI tokens at $11.42 each between March 1 and March 13, they faced liquidation, losing 17,100 UNI tokens. This forced liquidation led to a significant financial maneuver, resulting in a $1.67 million loss, a stark example of the high stakes involved in crypto trading strategies and portfolio management.

In response to the SEC’s actions, Uniswap founder Hayden Adams issued a strong statement, criticizing the SEC for favoring traditional financial systems over consumer interests. Adams underscored Uniswap’s commitment to regulatory compliance and legal clarity, expressing determination to defend the platform and the broader DeFi protocols against what he perceives as unjust scrutiny. His stance highlights the ongoing tension between decentralized trading platforms and regulatory bodies in the crypto industry.

The Legal Battle Ahead

The Wells notice issued to Uniswap signals the start of a potentially lengthy legal battle, with significant implications for DeFi protocols and the crypto industry at large. Hayden Adams emphasized the critical nature of this fight, not just for Uniswap but for the future of decentralized trading platforms and financial inclusion. This situation underscores the challenges of regulatory compliance and legal implications in navigating the evolving landscape of DeFi.

While Uniswap’s founder is prepared to contest the SEC’s lawsuit, the situation underscores the broader regulatory uncertainty facing decentralized trading platforms. This increased scrutiny from regulatory bodies has left many in the crypto industry concerned about the potential impact on investor confidence and the future of innovative platforms like Uniswap.

Read More: In Depth Analysis: Supra Oracles, An Emerging Cross Chain DEX and Oracle Network

Regulatory Scrutiny for DEXs

Uniswap’s current legal challenges are part of a larger trend of regulatory scrutiny within the cryptocurrency sector. The SEC has pursued actions against other platforms, including Ripple Labs and Coinbase, reflecting a growing focus on regulatory compliance across both decentralized and centralized exchanges. This environment poses unique challenges for the crypto industry, known for its permissionless and innovative nature.

The regulatory landscape for decentralized exchanges (DEXs) like Uniswap remains in flux, with the outcome of the SEC’s lawsuit poised to set a precedent. This case will test the limits of regulatory oversight over DeFi protocols, potentially shaping the future of how decentralized trading platforms operate within the broader crypto industry.

The Impact on Uniswap’s Token Value

Uniswap’s native token, UNI, has seen a notable decline in value following the SEC notice and lawsuit, marking a significant moment in price fluctuations within the crypto industry. In just one hour after the lawsuit news broke, UNI experienced a 10% drop from $11.21 to $10, and is currently trading at $9.41. Over the past month, UNI has navigated through considerable challenges, with its prices plummeting by 32% in the last 30 days, reflecting the volatile market trends.

The decline in UNI’s value mirrors the uncertainty and apprehension among investors within the crypto industry. The outcome of the SEC lawsuit is poised to play a pivotal role in determining UNI’s future trajectory and its overall market performance, spotlighting the influence of market trends on investor sentiment.

Read More : Unlocking Liquidity: Exploring Proof of Liquidity Protocols in DeFi

The Road Ahead for Uniswap

Uniswap’s legal battle with the SEC is a pivotal event for the decentralized exchange and the broader DeFi industry, highlighting the importance of regulatory compliance and legal implications. This lawsuit stands to influence the regulatory landscape significantly and shape investor confidence in decentralized trading platforms and DeFi protocols.

Despite the challenges ahead, Uniswap’s founder and the DeFi community are unwavering in their dedication to decentralization and financial inclusion. This legal battle will test Uniswap’s resilience and its ability to innovate while navigating regulatory hurdles, underscoring the platform’s role as a leading decentralized trading platform within the crypto industry.

Conclusion

The SEC’s notice and lawsuit against Uniswap have indeed sent shockwaves through the cryptocurrency market, with UNI’s value taking a significant hit. This legal challenge is set to shape the regulatory landscape for decentralized exchanges and influence the future of the DeFi protocols, highlighting the interplay between price fluctuations, regulatory compliance, and legal implications in the crypto industry.

Uniswap’s founder and the DeFi community’s steadfast commitment to revolutionizing financial inclusion shines through despite the looming legal uncertainties. Their dedication to transparency and innovation will be key in navigating the upcoming challenges. As the lawsuit unfolds, the crypto industry will be watching closely, understanding its impact on regulatory compliance, DeFi protocols, and the broader landscape of decentralized trading platforms.

Table of Contents

Disclaimer: This article is for informational purposes only and should not be construed as financial or legal advice. It is always recommended to conduct thorough research and consult with professionals before making any investment or legal decisions. Hash Herald took all precaution in production of this article but provides no warranties of accuracy of the material.