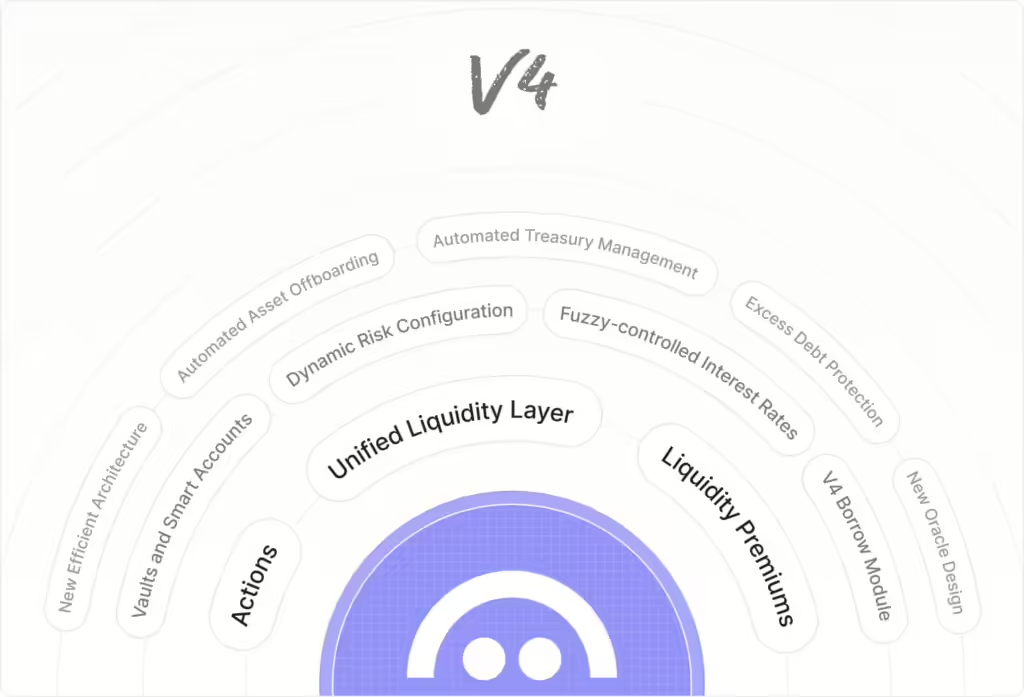

With the ever-evolving landscape of decentralized finance (DeFi), the announcement of Aave V4 captures the attention of stakeholders across the crypto ecosystem. This latest protocol proposal introduces a suite of upgrades aimed at enhancing the efficiency, security, and user experience of this widely adopted lending platform. V4 is not just an iteration but a substantial leap forward, incorporating new architecture designed to bolster risk management, improve liquidation strategies, and facilitate easier liquidity provisioning. At the heart of these advancements are enhancements meant to fortify the ecosystem against volatility, while enabling more sophisticated lending and borrowing features, such as credit delegation, smart accounts, and stable rate options.

This article delves into the key components of the V4 proposal, outlining the significant architectural changes and technical upgrades that promise to redefine the lending protocol. From the introduction of cross-chain liquidity to the integration of Chainlink automation for improved oracle design, each improvement is dissected to reveal its contribution towards a more secure and efficient platform. Special focus is placed on the GHO stablecoin enhancements, the deployment of smart accounts to elevate user experience, and the strategic risk management enhancements to ensure sustainability.

Through a detailed analysis of these updates, the article will explore how V4 aims to enhance liquidity provisioning, leverage liquidity premiums, and deploy custom actions for comprehensive DeFi solutions, setting a new benchmark in the saga of blockchain-based finance.

Aave V4 Proposal Overview

Summary of Improvements in V4 Proposal

- Introduction of a new architecture enhancing modularity and optimizing capital efficiency [7].

- Development of Aave-native stablecoin GHO for seamless integration [7].

- Innovative risk management tools and a more efficient liquidation engine [7].

- A Unified Liquidity Layer for agnostic, independent liquidity provisioning [7].

- Fully automated interest rates adjusting according to market demand [7].

- Liquidity Premiums for adjusted borrowing costs based on collateral composition [7].

- Introduction of Smart Accounts to simplify user interactions with the protocol [7].

- Dynamic configuration mechanism per asset for flexible asset management [7].

- Automated asset offboarding to streamline governance procedures [7].

- Custom automatic actions (Actions) in response to governance decisions [7].

- Novel mechanism to track insolvent positions and manage excess debt [7].

- Enhanced integration of GHO, improving UX and yield for stablecoin suppliers [7].

- Emergency Redemption Mechanism for handling prolonged GHO depegging scenarios [7].

Detailed Discussion on V4 Enhancements

V4 represents a significant evolution in the DeFi and crypto ecosystem, introducing a suite of improvements aimed at enhancing the protocol’s efficiency, security, and user experience. Each of these enhancements contributes to a more robust and flexible lending platform that addresses the needs of both users and developers.

New Architecture and Modularity

The most notable change in V4 is the introduction of a completely new architecture that emphasizes modularity and efficiency. This shift is designed to reduce governance overhead, optimize capital efficiency, and allow for the seamless integration of innovations such as the Aave-native stablecoin GHO [7]. By maintaining a consistent architecture across versions, Aave ensures that integrators can continue their work without major disruptions, fostering innovation without sacrificing stability [7].

Unified Liquidity Layer

V4 introduces a Unified Liquidity Layer, expanding on the concept of Portals from Aave V3. This layer provides a fully agnostic, independent, and abstracted infrastructure for liquidity provisioning, managing supply/draw caps, interest rates, assets, and incentives. It allows for the future onboarding of new borrow modules by the Aave DAO without the need to migrate liquidity, addressing the issue of fragmented liquidity in previous versions [7][11].

Automated Interest Rates and Liquidity Premiums

The proposal features fully automated interest rates, leveraging innovative concepts currently in development for GHO. This automation aims to optimize rates for both suppliers and borrowers by adjusting interest rates based on market demand [7]. Additionally, Liquidity Premiums are introduced to adjust borrowing costs according to the risk profile of the collateral, addressing the limitations observed in Aave V3 [7].

Smart Accounts and User Experience

V4 marks the introduction of Smart Accounts, designed to solve major UX challenges by allowing users to manage positions using a single wallet. This simplification extends to the introduction of Aave Vaults, which enable borrowing without supplying collateral to the liquidity layer [7]. These features significantly enhance the user experience, making the protocol more accessible and user-friendly.

Dynamic Configuration and Asset Management

The dynamic configuration mechanism per asset introduced in V4 allows users to remain “hooked” to the configuration of an asset at the time of borrowing. This flexibility ensures that users are not adversely affected by changes in asset configurations [7]. Alongside this, the proposal includes an automated procedure for asset offboarding, streamlining governance processes and enhancing the protocol’s adaptability [7].

Risk Management and Governance

V4 proposes innovative risk management tools, including a mechanism to track insolvent positions and manage excess debt. This feature ensures the stability of the protocol by preventing the spread of bad debt across assets [7]. Additionally, custom automatic actions in response to governance decisions enable users to respond proactively to changes in the protocol, further enhancing risk management [7].

GHO Integration and Emergency Redemption Mechanism

The proposal outlines several features aimed at integrating GHO more natively within V4, including native GHO minting and “soft” liquidations. These enhancements improve the user experience and yield for stablecoin suppliers, making GHO a more competitive stablecoin in the DeFi ecosystem [7]. Furthermore, an Emergency Redemption Mechanism is proposed to handle prolonged and heavy depegging scenarios of GHO, ensuring the stability of the protocol during market fluctuations [7].

In summary, V4 introduces a comprehensive suite of enhancements that promise to significantly improve the DeFi and crypto ecosystem. These improvements, from the new architecture and Unified Liquidity Layer to automated interest rates, Smart Accounts, and enhanced risk management tools, position V4 as a leading protocol in the evolving landscape of decentralized finance.

Key Architectural Changes

Unified Liquidity Layer

V4 introduces a groundbreaking Unified Liquidity Layer, a significant shift from the Portals concept in Aave V3. This new layer is fully agnostic, independent, and abstracted, designed to manage supply/draw caps, interest rates, assets, and incentives. It allows for seamless integration of new borrow modules and the offboarding of old ones without the need to migrate liquidity, addressing the fragmentation of liquidity seen in previous versions [14][16][17]. This layer supports both supplied and natively minted assets, enhancing integration with Aave’s GHO stablecoin and other collateralized assets [13][16].

Modular Design

The architecture of V4 is built from the ground up to be modular and efficient. This new design minimizes the impact on third-party integrators, allowing them to continue their development without major disruptions. The modular approach enables the addition or improvement of borrowing features like isolation pools, RWA modules, and CDPs without requiring a complete overhaul of the system or the liquidation module. This design philosophy not only facilitates innovation but also maintains consistency across different versions of the protocol, preventing disruptions in integrator activities and fostering a stable development environment [14][15][18].

Cross-Chain Liquidity Layer

Unified Cross-Chain Liquidity Layer (CCLL)

V4 introduces a Unified Cross-Chain Liquidity Layer (CCLL), a pivotal enhancement that aggregates liquidity from multiple networks into a single protocol [23][19]. This layer is powered by Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which has recently completed a permissionless rollout [23]. The integration of CCIP enables Aave to scale up as a fully cross-chain liquidity protocol, allowing borrowers to access instant liquidity across all supported networks [23][19].

Integration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP)

The use of Chainlink’s CCIP in V4’s liquidity layer marks a significant technical upgrade. CCIP facilitates secure and efficient cross-chain communications, allowing smart contracts on one blockchain to send messages and execute actions on another. This functionality is crucial for maintaining the integrity and security of cross-chain transactions, particularly in the transfer of Aave’s native stablecoin, GHO, across different blockchains [21].

Enhancing Liquidity Efficiency Across Blockchains

The Cross-Chain Liquidity Layer in V4 addresses the issue of liquidity fragmentation across blockchains. By enabling interoperability between different blockchain networks, it allows users to leverage the unique strengths of each network, whether for financial settlements, gaming, or other use cases [24]. This flexibility significantly enhances liquidity efficiency, impacting overall market dynamics by lowering trading fees and improving the trading experience through Automated Market Makers (AMMs) [24].

Challenges and Opportunities in Cross-Chain Liquidity

Despite the clear advantages, the implementation of cross-chain liquidity comes with its set of challenges. The loss of atomicity in transactions can pose risks, such as transaction reversals and extended finality periods, which need to be carefully managed to maintain trust and efficiency in the protocol [24]. However, the potential benefits, including lowered costs for users and enhanced market efficiency, present substantial opportunities for V4 to influence the broader DeFi and crypto ecosystem positively [24].

By addressing these challenges and leveraging the opportunities, V4’s Cross-Chain Liquidity Layer aims to provide a robust foundation for the future growth of decentralized finance, facilitating seamless liquidity across multiple blockchain networks.

Technical Upgrades for Enhanced Efficiency

Support for Non-EVM Layer 1 Deployments

Aave V4 plans to extend its reach by supporting non-EVM (Ethereum Virtual Machine) Layer 1 deployments, broadening accessibility across various blockchain platforms [27]. This strategic move taps into an untapped market, potentially unlocking billions in Total Value Locked (TVL) that was previously inaccessible due to Aave’s core contracts being written in Solidity, which necessitated rewriting for non-EVM chains [25].

Fuzzy-Controlled Interest Rates

The introduction of fuzzy-controlled interest rates in V4 represents a significant enhancement, designed to reduce the overhead for the DAO and risk teams. This feature automates the adjustment of interest rates based on real-time market conditions, optimizing capital efficiency [25][31][32]. The fuzzy logic allows for dynamic control of the interest rate curves, actively adjusting the kink point according to market demand, thus enhancing the protocol’s responsiveness to economic changes [28][32].

Dynamic Risk Configuration

V4 introduces a dynamic configuration mechanism per asset, which allows users to remain “hooked” to the configuration they borrowed under, even if new configurations are implemented [27][31]. This innovation not only improves risk management by creating independent risk configurations for each asset but also reduces liquidity risk for suppliers and allows for offloading risk management functions to external entities without changing trust assumptions [28][31]. The ability to maintain asset-specific configurations that evolve independently of existing loans significantly reduces governance friction and enhances the stability and flexibility of the protocol [29][30].

GHO Stablecoin Enhancements

Integration Improvements

V4 significantly enhances the integration of its GHO stablecoin, aiming to improve both the user experience and yield for stablecoin suppliers. Notably, the protocol now supports native GHO minting, allowing for more efficient minting processes compared to previous implementations [34][37][40]. This upgrade is crucial in making GHO a more integral and fluid part of the Aave ecosystem, facilitating seamless transactions and interactions within the platform.

Soft Liquidations

V4 introduces a “soft” liquidation mechanism, modeled after the liquidation model first pioneered by crvUSD. This approach involves a Lending-Liquidating Automated Market Maker (LLAMM), which subdivides liquidity into ranges that can be selected to manage the conversion to GHO during market downturns and the repurchase of collateral during upturns. The new design offers several advantages:

- Users have the flexibility to choose which collateral to liquidate to GHO within their basket of collaterals.

- Users can select which collateral to buy back from all the assets available on the Aave Protocol, even those not initially supplied.

- GHO will automatically earn interest in markets where it can be supplied, enhancing its attractiveness as a stablecoin option [34][37][40][41].

Emergency Redemption Mechanism

In response to potential prolonged and heavy depegging scenarios of GHO, V4 proposes an Emergency Redemption Mechanism. This mechanism is designed to gradually redeem collaterals from positions with the lowest health factor to GHO, repaying their debt. This feature works in conjunction with automated interest rates and soft liquidations to scale GHO effectively while ensuring its stability and reliability within the market [34][37][40][41][42]. This strategic addition is aimed at safeguarding the Aave ecosystem from extreme market volatilities and maintaining the trust and security of its users’ investments in GHO.

Smart Accounts and User Experience

Streamlining with Multiple Smart Accounts

V4 introduces Smart Accounts, a transformative feature designed to streamline user interactions with the protocol. Previously, managing multiple positions, especially when borrowing using eMode or isolated assets, required separate wallets. With the implementation of Smart Accounts in V4, users can now manage multiple positions from a single wallet interface. This significant enhancement allows users to create as many smart accounts as needed, simplifying the process and enhancing user experience [43][44][45].

Additionally, Smart Accounts facilitate the use of Aave Vaults, a feature highly requested in the Aave governance forums. Vaults enable users to borrow without having to supply collateral directly to the liquidity layer. Instead, collateral is deposited in the Smart Account, where it remains non-borrowable and locked unless a borrow position is active or a liquidation event occurs. This mechanism allows users to segregate risk more effectively, potentially improving yields for those who supply collateral to the liquidity layer [43][44].

Automated Actions in Response to Governance Decisions

V4 also enhances user experience by introducing automated actions (Actions) that respond to governance decisions. This feature allows users to set up custom automatic actions based on changes in governance, such as adjustments to the risk limits for borrowing certain assets. For example, if the governance lowers the liquidation threshold for a particular asset, users can automatically increase collateral for that asset or repay part of the asset to avoid potential liquidation [43][46].

These automated actions are designed to reduce the need for constant monitoring of the governance forum for updates. By enabling users to configure actions that automatically adjust their positions in response to governance decisions, V4 not only simplifies the management of investments but also enhances the responsiveness of the platform to changes, thereby improving risk management and user confidence in the platform [43][46].

Risk Management Enhancements

Automated Risk Adjustments

V4 introduces a dynamic configuration mechanism for asset risk management, addressing one of the main challenges faced in V3. In the previous version, risk parameters, especially the liquidation threshold, could not be adapted to changing market conditions without affecting both current and future borrowers. This limitation often led to governance overload and potential discomfort due to unwanted liquidations. V4’s dynamic configuration allows users to remain “hooked” to the asset configuration present at the time of borrowing. If market conditions necessitate a new asset configuration, it is created without impacting existing borrowers, significantly reducing the need for governance interventions and enhancing the protocol’s adaptability to market dynamics [49] [50] [52] [53].

Furthermore, Aave V4 integrates an automated asset delisting mechanism. Triggered by the governance layer, this system methodically lowers the liquidation threshold of an asset until it reaches zero, effectively removing the asset’s lending capabilities. This process is akin to manual delisting but greatly simplifies governance, ensuring a smoother and more efficient risk management workflow [50] [53] [54].

Excess Debt Protection Mechanisms

The shared liquidity model, while offering numerous benefits, also poses a risk of contagion should an asset accumulate excess debt. This excess debt, arising from custody or liquidity risks, can potentially spread bad debt across the protocol. Aave V4 tackles this challenge by introducing a novel mechanism designed to track insolvent positions and automatically manage accumulated excess debt. A threshold for excess debt is established, and once surpassed, the implicated asset automatically loses its borrowing capacity. This proactive approach prevents the spread of bad debt, safeguarding the ecosystem’s stability and integrity [49] [50] [52] [53].

Additionally, V4’s excess debt protection mechanism is complemented by the use of Chainlink’s Proof of Reserve and other monitoring services. These tools, already utilized in V3, play a crucial role in mitigating custody risk. However, the new mechanism’s ability to automatically calculate and manage excess debt resulting from liquidations represents a significant advancement in the protocol’s risk management capabilities [49] [52].

By implementing these enhancements, V4 significantly improves its risk management framework. The dynamic configuration function and the automated asset delisting mechanism, alongside the excess debt protection mechanisms, collectively contribute to a more secure, efficient, and adaptable lending protocol. These advancements are not only crucial for maintaining the health of the Aave ecosystem but also exemplify the protocol’s commitment to innovation and security in the rapidly evolving DeFi landscape.

Development Timeline and Funding

Proposed Timeline

The development of Aave Protocol V4 is currently in an advanced research phase, with a structured timeline contingent upon community approval. Following the proposed schedule, the research phase is expected to conclude in Q2 2024, paving the way for the commencement of development by the end of the same quarter. The first prototype of Aave V4 is anticipated in Q4 2024, with the completion of code, auditing, and the official release slated for Q1-Q2 2025 [55]. This timeline underscores the protocol’s evolution, building on the success of Aave V3, which demonstrated remarkable growth by achieving a Total Value Locked (TVL) of $7 billion in less than a year.

Notably, certain innovations, including fuzzy-controlled interest rates and a new oracle design, initially conceptualized for V4, are being developed to function with Aave V3, indicating a continuous improvement approach [55][58].

The development strategy emphasizes building in public, with plans to release an initial prototype and finalize its implementation while conducting audits and security assessments. This approach facilitates community engagement and feedback, contributing to the development of safer and more reliable code. However, it is important to note that some features might be subject to changes, reworks, or removals if unexpected development challenges arise [55][58].

Funding Requests and Allocations

To support the ambitious development timeline, Aave Labs has requested a significant grant totaling approximately $17 million, comprising 15 million GHO and 25,000 stkAAVE. This funding is earmarked for the execution of the first year of a three-year plan, covering research, development, and security audits [56][57]. The proposed budget reflects Aave Labs’ commitment to engaging with the community through regular feedback sessions and annual reviews, ensuring the project’s development aligns with community expectations and dynamic market conditions [57][59].

Furthermore, Aave Labs advocates for a transition from a retroactive to a proactive funding model, emphasizing a transparent budgeting approach that requires community approval before project commencement. This model aims to foster a collaborative development environment, where community input and approval play a critical role in shaping the protocol’s future [57][59].

Additionally, the proposal outlines a renewal of AGD for the next six months, including an increase in AGD’s GHO allowance by $328,000. The total budget for this period is split between a Grants Budget and an Operations Budget, with a focus on kickstarting the growth of new teams building on top of Aave and GHO. This funding strategy underscores the importance of increasing resources and operating more independently to support the protocol’s growth and development [60].

Conclusion

The advancements introduced in Aave V4 mark a pivotal moment for the decentralized finance sector, demonstrating a robust commitment to enhancing user experience, efficiency, and security within the crypto ecosystem. By embracing innovative features like the Unified Liquidity Layer, Smart Accounts, and enhanced GHO stablecoin integration, V4 sets new benchmarks for liquidity management, ease of use, and risk mitigation. These improvements not only elevate the Aave platform but also bolster the entire DeFi landscape, underscoring the potential for decentralized finance to evolve into an even more seamless, secure, and user-friendly domain.

As we ponder the implications of these developments, it’s clear that Aave V4’s comprehensive suite of enhancements are geared towards solidifying the protocol’s position at the forefront of the DeFi innovation wave. The protocol’s focus on modularity, cross-chain liquidity, and automated risk management systems represents a forward-thinking approach, optimizing for a future where finance is increasingly decentralized, accessible, and integrated across multiple blockchain ecosystems. Aave’s journey thus far exemplifies a relentless pursuit of excellence, and with V4, the protocol is well-poised to shape the trajectory of decentralized finance, encouraging a broader adoption and understanding of DeFi principles and their vast applications.

FAQs

What is Aave and how does it function?

Aave is a decentralized, open-source protocol that enables users to lend and borrow digital assets. Individuals who lend their cryptocurrencies can earn interest, while borrowers can use their digital assets as collateral to secure loans in various altcoins and stablecoins available on the platform.

How does Aave generate revenue?

The Aave protocol generates income through its treasury, which consists of the ecosystem reserve (holding AAVE tokens) and treasury collectors. These collectors accumulate fees from two main sources: a reserve factor, which is a percentage of the interest paid by borrowers, and instant liquidity fees, which are percentages taken from transactions offering instant liquidity (applicable only in version 3 of the protocol).

What are the current earnings for staking on Aave?

As of the latest data, the reward rate for staking on Aave stands at approximately 4.79% annually. This means stakers can expect to earn an average interest rate of 4.79% over a year for holding their assets in the protocol. This rate has remained stable at 4.79% from the previous day and has seen a slight increase from 4.77% a month ago.

What was Aave called before its rebranding?

Initially, Aave was known as ETHLend when it was first launched. In September 2018, the platform underwent a rebranding to Aave, marking its evolution from a peer-to-peer lending service to a more comprehensive decentralized finance (DeFi) ecosystem.

Table of Contents

References

[1] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[2] – https://cryptopotato.com/aave-labs-unveils-major-upgrades-and-expansions-with-aave-v4-proposal/

[3] – https://cryptoadventure.com/aaves-next-chapter-v4-protocol-proposal-outlines-ambitious-roadmap/

[4] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[5] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[6] – https://m.odaily.news/en/post/5195052

[7] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[8] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[9] – https://cryptoadventure.com/aaves-next-chapter-v4-protocol-proposal-outlines-ambitious-roadmap/

[10] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[11] – https://cryptopotato.com/aave-labs-unveils-major-upgrades-and-expansions-with-aave-v4-proposal/

[12] – https://cryptoadventure.com/aaves-next-chapter-v4-protocol-proposal-outlines-ambitious-roadmap/

[13] – https://unchainedcrypto.com/aave-v4-to-come-mid-2025-with-unified-liquidity-layer-and-fuzzy-rates/

[14] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[15] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[16] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[17] – https://cryptopotato.com/aave-labs-unveils-major-upgrades-and-expansions-with-aave-v4-proposal/

[18] – https://m.odaily.news/en/post/5195052

[19] – https://thedefiant.io/news/defi/aave-proposes-v4-iteration-and-aave-network-validium

[20] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[21] – https://governance.aave.com/t/arfc-gho-cross-chain-launch/17616

[22] – https://www.binance.com/en/square/post/2024-05-02-aave-labs-proposes-major-upgrades-including-aave-v4-and-cross-chain-liquidity-layer-7570560809538

[23] – https://thedefiant.io/news/defi/aave-proposes-v4-iteration-and-aave-network-validium

[24] – https://www.linkedin.com/pulse/significance-cross-chain-liquidity-krzysztof-gogol-8zwte

[25] – https://governance.aave.com/t/temp-check-aave-2030/17539/8

[26] – https://cryptopotato.com/aave-labs-unveils-major-upgrades-and-expansions-with-aave-v4-proposal/

[27] – https://cryptoadventure.com/aaves-next-chapter-v4-protocol-proposal-outlines-ambitious-roadmap/

[28] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[29] – https://beincrypto.com/inside-aave-v4-lending-protocol/

[30] – https://unchainedcrypto.com/aave-v4-to-come-mid-2025-with-unified-liquidity-layer-and-fuzzy-rates/

[31] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[32] – https://m.odaily.news/en/post/5195052

[33] – https://beincrypto.com/inside-aave-v4-lending-protocol/

[34] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[35] – https://news.bitcoin.com/aave-labs-unveils-ambitious-plans-for-protocol-v4-enhancing-gho-stability-and-cross-chain-liquidity/

[36] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[37] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[38] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[39] – https://news.bitcoin.com/aave-labs-unveils-ambitious-plans-for-protocol-v4-enhancing-gho-stability-and-cross-chain-liquidity/

[40] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[41] – https://m.odaily.news/en/post/5195052

[42] – https://www.binance.com/en-JP/square/post/7559013549065

[43] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[44] – https://m.odaily.news/en/post/5195052

[45] – https://beincrypto.com/inside-aave-v4-lending-protocol/

[46] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[47] – https://governance.aave.com/t/governance-weekly-recap-2024/16269

[48] – https://medium.com/b-protocol/the-power-of-automated-decision-making-in-defi-risk-management-processes-fa8ecd65a7ad

[49] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[50] – https://m.odaily.news/en/post/5195052

[51] – https://thedefiant.io/news/defi/aave-proposes-v4-iteration-and-aave-network-validium

[52] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[53] – https://m.odaily.news/en/post/5195052

[54] – https://www.coinlive.com/en/news/some-thoughts-on-aave-v4-should-every-major-protocol-launch

[55] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[56] – https://cointelegraph.com/news/aave-unveils-v4-protocol-overhaul-2030-roadmap

[57] – https://cryptoslate.com/aave-proposes-upgrade-to-v4-in-strategic-2030-roadmap/

[58] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[59] – https://cryptoslate.com/aave-proposes-upgrade-to-v4-in-strategic-2030-roadmap/

[60] – https://governance.aave.com/t/arfc-updated-aave-grants-continuation-proposal/15529

[61] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

[62] – https://www.theblock.co/post/292056/aave-v4-governance-proposal-aave-labs

[63] – https://cryptoadventure.com/aaves-next-chapter-v4-protocol-proposal-outlines-ambitious-roadmap/

[64] – https://cryptonews.net/news/defi/28957749/

[65] – https://bitpapa.com/blog/how-to/rise-and-impact-aave-crypto-empowering-decentralized-finance

[66] – https://governance.aave.com/t/temp-check-aave-protocol-v4-development-proposal/17541

Disclaimer: The information contained in this article is for informational purposes only. It should not be considered as financial or investment advice. The reader should do their own research before making any financial decisions based on the information provided above. Hash Herald is not responsible for any losses in market