In the dynamic realm of decentralized finance (DeFi), innovation is a constant. Berachain emerges as a formidable challenger, boasting unique features that set it apart in the DeFi landscape. With competitive transaction rates and seamless EVM-compatible chain integration, Berachain enables the utilization of existing tools and smart contracts. Its novel proof-of-liquidity consensus mechanism is designed to incentivize users to contribute to network expansion. This analysis delves into Berachain’s core principles and its potential to revolutionize DeFi.

Berachain captured the spotlight with a significant $42 million US-dollar funding round in 2023. Its testnet is operational, and Binance has confirmed an upcoming airdrop of BERA tokens in March. This development positions Berachain as a notable player in the DeFi arena, with anticipation building around its testnet on platforms like OpenSea. We can say that BERA will be a proof of liquidity coin in the blockchain universe.

READ MORE: Berachain Secures $100 million in series B funding

Table of Contents

Introducing Berachain: A Game-Changer Built for the Future

Berachain is a blockchain initiative grounded in the Polaris EVM—a custom-built module—allowing developers to craft smart contracts using both Solidity and Vyper. Constructed on the Cosmos SDK for enhanced modularity, Berachain’s white paper underscores its commitment to modularity, facilitating access to a diverse array of data, applications, smart contracts, and NFTs. The Cosmos SDK docs and Solidity Read the Docs are valuable resources for developers engaging with Berachain’s versatile ecosystem.

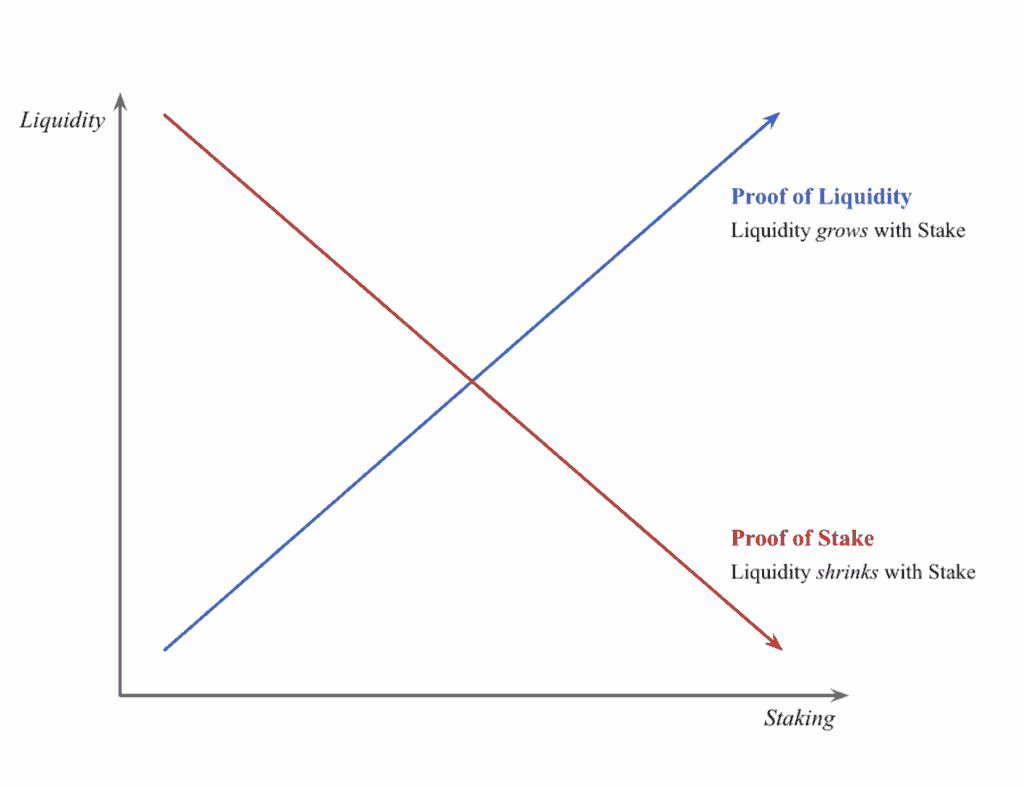

As one of the EVM-compatible chains, Berachain doesn’t replicate all the functionalities of the Ethereum network. However, its primary environment supports all abstraction methods and programming languages that EVM chains endorse, akin to other Layer 1 blockchains. Berachain’s Proof-of-Liquidity consensus method is an innovative enhancement to the Proof-of-Stake mechanism, which underpins major blockchains like Polygon, BNB, and Ethereum.

While the proof-of-stake (PoS) mechanism is robust, it’s not without challenges. Centralization issues arise when staking the native coin to a limited set of validators. Security concerns and liquidity issues also surface as substantial coin holdings are locked with validators, impacting the overall chain economy’s liquidity. The concept of staking is being reexamined to address these concerns.

Demystifying Berachain’s Core Functionalities: The Power of EVM Compatibility

What is EVM compatibility?

The Ethereum Virtual Machine (EVM) serves as the computational engine where Ethereum smart contracts are executed, setting the stage for an EVM-compatible chain to facilitate seamless operations across the blockchain network. An EVM-compatible chain enables the execution of smart contracts originally designed for Ethereum with minimal adjustments, akin to running the same application on both Windows and macOS platforms.

READ MORE:

Benefits of evm compatibility for Developers

- Portability: The compatibility of EVM with other blockchains enables developers to deploy Ethereum decentralized applications (dApps) effortlessly, fostering user adoption by saving significant time and resources that would otherwise be spent rewriting code.

- Wider Reach: By deploying a project on an EVM-compatible chain, developers can leverage the significant network effects, tapping into a broader pool of users and liquidity from the well-established Ethereum ecosystem.

- Familiar Tools: Developers can seamlessly transition to EVM-compatible environments, utilizing familiar development tools, libraries, and programming languages like Solidity, which significantly enhances user adoption within the Ethereum landscape.

- Leveraging Ethereum’s Network Effect:With the largest developer community and an extensive array of tools and dApps, Ethereum’s network growth is unparalleled. EVM-compatible chains benefit from this robust ecosystem, gaining access to a wealth of developer resources and expertise.

Examples of EVM-compatible blockchains:

- Binance Smart Chain (BSC)

- Polygon (MATIC)

- Avalanche (AVAX)

- Fantom (FTM)

Overall

EVM compatibility stands as a pivotal benefit for blockchain developers, simplifying the development process, encouraging interoperability with Ethereum, and connecting with an expansive, EVM-compatible chain ecosystem. An EVM-compatible chain enables the execution of smart contracts originally designed for Ethereum with minimal adjustments, akin to running the same application on both Windows and macOS platforms.

Novel Approach: Unveiling the Proof-of-Liquidity Consensus Mechanism

Berachain is set to address common blockchain challenges by adopting the proof of liquidity mechanism, a novel strategy aimed at boosting the network’s efficiency and security.

Proof of Liquidity consensus Mechanisms

The innovative proof of liquidity consensus model emerges to address the Proof-of-Stake (PoS) system’s drawbacks, such as the issue of capital lock-up affecting DeFi fluidity. As an EVM-compatible chain, its primary goal is to enhance capital efficiency, vital for the prosperity of decentralized exchanges (DEXes) and the enrichment of the DeFi space.

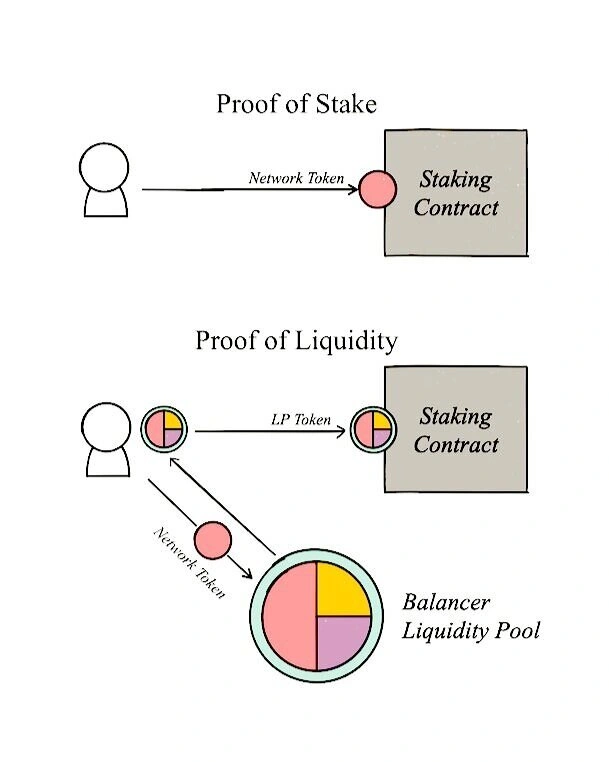

Within the proof-of-liquidity (PoL) framework, users become liquidity providers by contributing assets to liquidity pools, subsequently earning a governance token. This token can be delegated to validators, who then produce blocks based on the delegated tokens’ weight. This innovative approach distinguishes the delegation token from the gas token used for chain operations, ensuring that the staking token and on-chain activities employ distinct tokens. Consequently, this proof of liquidity strategy enhances liquidity and addresses stake centralization issues prevalent in proof-of-stake (PoS) systems, promoting a more decentralized inflation process.Proof-of-Liquidity (PoL) advances the Proof-of-Stake (PoS) concept with the ambition to rectify its limitations and establish a more robust blockchain governance framework.

Read more about proof of liquidity here

Delving into the proof of liquidity (PoL) inner mechanics reveals its potential to refine the governance model:

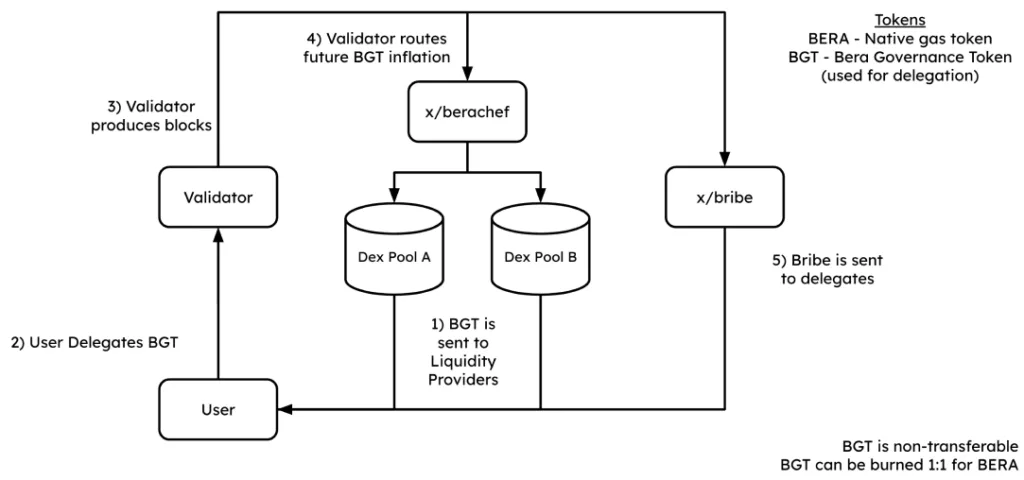

1. Supplying Liquidity: Within the Proof-of-Liquidity ecosystem, users serve as liquidity providers by depositing crypto assets into DEX liquidity pools and are rewarded with Bera Governance Tokens (BGT). These tokens are crucial in the delegation process, fortifying the proof-of-liquidity mechanism and fostering a more equitable DEX environment.

2. Delegating to Validators: Holders of Bera Governance Tokens (BGT) have the privilege to delegate their tokens to validators, who are responsible for generating new blocks on the blockchain. The power a validator holds in blockchain governance is proportionate to the amount of BGT they receive, embodying the Proof-of-Liquidity ethos. This consensus crunchbase is integral to the blockchain’s operational integrity.

3. Reward System: In the Proof-of-Liquidity ecosystem, the network effects are evident as both validators and delegators benefit from their participation. Validators receive block rewards for enhancing network security and stability, while delegators earn returns for entrusting their BGT to validators. To attract delegators, validators might provide extra incentives, potentially affecting the equitable distribution of block rewards and voting power and raising concerns about fairness and possible manipulation in blockchain governance.

4. Governance Voting: Acting as network custodians, validators wield the power to vote on critical decisions, such as modifying the inflation rate of BGT tokens within liquidity pools. This consensus crunchbase within the Proof-of-Liquidity voting system empowers the community to significantly influence the trajectory of the Berachain ecosystem’s blockchain governance.

What Bera Chain Does Differently is:

1. Different Tokens: At the heart of the Proof-of-Liquidity model lies the Bera Governance Token (BGT), which functions as a delegation token separate from gas tokens for network transactions. This strategic division is designed to boost security and liquidity in the economic model of the proof-of-liquidity system.

2. By fostering the creation of new BGTs, Berachain Exchange (BEX) not only promotes Proof of Liquidity but also serves as a compelling incentive for liquidity providers to sustain the platform’s liquidity, cementing its role as a key liquidity provider in the ecosystem.

Under the Hood: Exploring Berachain’s Technical Prowess

Berachain’s Polaris EVM, an EVM compatible chain, is meticulously engineered for Berachain, offering an elevated EVM experience that surpasses the standard Ethereum EVM. Developers and users benefit from the reliable Ethereum functionality and the advanced features of Polaris Ethereum, which enable the creation of stateful precompiles and custom modules for more powerful and efficient smart contracts.

In assessing Berachain’s network growth within the decentralized finance sector, it’s crucial to compare its features with those of other DeFi giants. This comparative analysis should consider Berachain’s speed, scalability, and security against leading blockchains like Solana (SOL), Polygon (MATIC), and Avalanche (AVAX) to gauge its competitive standing.

- Speed (Transactions Per Second, or TPS):

Berachain is still in development, and while specific transaction per second (TPS) data has not been released, the team’s commitment to network effects is clear. They aim to achieve very high transaction speeds, with ambitions of reaching up to 65,000 TPS, as outlined in their documentation.

Solana (SOL): Transaction speeds can surpass 50,000 TPS during peak moments.

Polygon (MATIC) is experiencing network growth as an emerging crypto exchange, offering faster transaction times than Ethereum. Current estimates suggest it can handle between 6,000 and 10,000 transactions per second, showcasing its potential in the DeFi space.

Avalanche (AVAX): Claims to have fast transactions of over 4.5k TPS with low latency.

- Scalability:

The Berachain development team is dedicated to scalability, which is a key aspect of network effects, aiming to process a high volume of transactions with ease. However, the specifics of Berachain’s scalability features are yet to be revealed at this stage.

Solana (SOL) is recognized for its network growth and innovative Proof-of-History (PoH) consensus mechanism. This, in tandem with proof-of-stake (PoS), significantly bolsters the platform’s scalability and performance.

Matic, now widely recognized as Polygon, amplifies network effects by serving as a sidechain solution to Ethereum, markedly enhancing decentralized networks’ performance and scalability by offloading transactions from the overburdened Ethereum network.

Avalanche (AVAX) distinguishes itself in the decentralized network landscape by deploying its cutting-edge Snowman consensus mechanism, which is tailored to foster network growth while maintaining a high level of security and scalability.

- Security:

The development of Berachain is anchored in the strength of its Proof-of-Liquidity (PoL) consensus protocol, a cornerstone for ensuring network stability. As the platform evolves, the efficacy of this proof-of-liability approach will be validated through comprehensive real-world applications and meticulous audits.

Solana (SOL) remains a formidable force in the expansion of decentralized networks, striving for network growth despite facing security scrutiny. The platform is dedicated to enhancing its security protocols to address concerns raised by intermittent network disruptions and potential weaknesses.

Polygon (MATIC) not only fortifies decentralized networks through the inherited security of Ethereum as a sidechain but also underscores the significance of network effects by securing the critical Polygon bridge that links it to the Ethereum ecosystem.

Avalanche (AVAX) leverages its SNOWMAN consensus mechanisms to strengthen its position within decentralized networks, contributing to network growth and resilience against diverse threats. Yet, the validation of its security measures over the long term remains an ongoing endeavor.

Unveiling the Economic Engine of Berachain: Tokenomics

Berachain’s unique ecosystem is powered by an economic model that weaves together three primary tokens, each playing an essential role in preserving the network’s operational efficiency and economic stability.

BERA Token:

- Function: As the native token of the Berachain network, it’s often described as the essential ‘gas token’ that powers transactions and operations within the ecosystem, playing a pivotal role in driving user adoption.

- Purpose: Facilitate transactions on the blockchain by paying transaction fees.

- Availability: Currently unavailable to the public as the Mainnet launch hasn’t occurred.

BGT (Bera Governance Token):

- Function: A non-transferable token earned through providing liquidity on the Berachain Exchange (BEX).

- Governance Role: Berachain’s native token not only empowers holders to delegate to validators and engage in blockchain governance, including voting on incentives for liquidity pools, but also plays a part in the consensus, thereby shaping the network’s future.

- Rewards and Incentives: By holding the Berachain token, individuals can earn rewards from the network’s operations and receive potential incentives from validators for their participation, which contributes to the network effects of the ecosystem.

- Unique Feature: Berachain’s BGT stands out with its one-way burn mechanism, enabling users to convert to BERA at a 1:1 ratio. This emphasizes a commitment to a deflationary economic model that does not permit reverse conversion, enhancing the token’s value.

HONEY Stablecoin:

- Function: A stablecoin called HONEY, pegged to the US dollar.

- Purpose: The goal of Berachain is to ensure price stability within the network, a fundamental aspect of the optimal functioning of a myriad of decentralized applications guided by a carefully designed economic model.

- Availability: Similar to BERA, it is currently unavailable due to the pending Mainnet launch.

In essence, Berachain’s tokenomics showcase innovative solutions in governance and economic incentives, with the economic model underlying BERA, BGT, and the upcoming HONEY stablecoin designed to foster an efficient, secure, and user-centric blockchain ecosystem.

BERA has its own DEX, and it will be interesting to witness the network growth as well as how many DEXs incorporate the chain into their systems, potentially expanding the reach and utility of Berachain.

A Glimpse into the Future: Berachain’s Roadmap and Beyond

Current Stage

As of March 2, 2024, Berachain is in the development stageThe developer team, known as the ‘Bear Necessities,’ is dedicated to fostering user adoption by maintaining transparency. They keep the Berachain community informed about their progress through regular updates on the official website and various social media platforms.

- In January 2023, Berachain successfully launched its public testnet, ‘Artio’, marking a significant milestone. This launch has been instrumental in building artio support and allows developers and enthusiasts to explore the network’s capabilities and experiment with features similar to those found on platforms like testnet OpenSea, well ahead of the mainnet’s introduction.

- The Berachain mainnet, adhering to its projected schedule, was expected to be operational within three to four months following September 23rd, 2022, which could have coincided with January 2023, according to initial estimates. Despite this, as of March 2, 2024, the network effects have yet to culminate in an official launch date announcement for the Berachain mainnet.

Future features

- Berachain is on the brink of revolutionizing network growth by implementing cross-chain interoperability. This critical feature is designed to facilitate smooth communication and transactions across diverse blockchain networks, thereby nurturing a more interconnected and decentralized economic landscape.

- Berachain aims to revolutionize blockchain governance with cutting-edge features that are set to empower token holders with a more active role in consensus decision-making processes, as noted on platforms like Crunchbase.

- Committed to driving user adoption in the DeFi sector, Berachain is expanding its support for additional functionalities. The goal is to foster an environment that is conducive to the creation of innovative decentralized dApps, thereby enriching the DeFi ecosystem.

A key aspect to monitor within the BERA ecosystem is the integration of Oracles. These are crucial for providing definitive pricing information in the DeFi space, a move that is expected to generate significant network effects.

BeraChain Airdrop:

By harnessing the Cosmos SDK and introducing the innovative Proof-of-Liquidity mechanism, Berachain is set to incentivize engagement by rewarding early testnet participants with an airdrop. This move highlights the platform’s strategy to attract liquidity providers. Here’s your guide to getting involved with Berachain and potentially reaping the benefits of the airdrop.

- Obtain Test Tokens: Secure $BERA tokens by visiting the Berachain Faucet and providing your wallet address.

- Engage with BEX (Berachain DEX): Access BEX, connect your wallet, and swap 0.01 $BERA for both $stgUSDC and $BTC.

- Provide Liquidity: Head to the BEX Pool, contribute $BERA and $stgUSDC to the liquidity pool, and start farming $BGT tokens.

- Exchange for Honey: Convert $stgUSDC to $HONEY in the Honey App.

- Utilize the Bend App: Deposit your Bitcoin and borrow money at the Bend App.

- Trade on Berps: Open a long $ETH position using $HONEY on Berps.

- Deposit in Vault: Place $HONEY in the Berps Vault and receive $bHONEY.

- Claim $BGT Tokens: After some time, claim your $BGT tokens at Bend and BEX.

- Delegate Your Tokens: Finally, delegate your tokens to validators on BGT Station.

Active engagement with Berachain’s testnet and performing certain tasks could improve users’ chances of receiving a potential airdrop, reflecting the platform’s commitment to fostering user adoption and valuing the contributions of its early supporters.

Read More: Exploring the Synergy of AI and Web3: A New Wave of Innovation

Conclusion: Berachain: A Beacon of Innovation in the Ever-Evolving DeFi Landscape

Predicting the future of any cryptocurrency or blockchain innovation is challenging due to the volatile nature of the sector. Yet, Berachain distinguishes itself with cutting-edge solutions that may drive network growth and enhance its position in the fiercely competitive market.

- EVM compatibility: streamlining development and migration for existing DeFi projects built on Ethereum.

- Proof-of-Liquidity (POL): Aiming to incentivize liquidity provision and potentially creating a more stable DeFi ecosystem.

- High-performance aspirations: focused on scalability and speed to facilitate faster and more cost-effective transactions.

However, to achieve success, Berachain must skillfully navigate the competitive landscape dominated by established blockchain players, with network effects playing a pivotal role in determining its future triumphs.

- Security and robustness: Demonstrating the effectiveness of proof of liquidity against vulnerabilities.

- Developer experience: Attracting developers by offering a smooth environment for building DeFi applications.

- Efficiency and scalability: Delivering on its claims of high transaction throughput and scalability.

- Liquidity incentives: proving the effectiveness of proof of liquidity in maintaining sufficient and stable liquidity.

Therefore, despite Berachain’s impressive features and its potential to influence the decentralised economy’s economic model, investors are advised to conduct thorough research and exercise continuous due diligence before making any investment decisions.

Disclaimer: All due diligence was done while producing this article. But please check the facts on the official BERAchain website, and once again, cryptocurrencies, DeFi, cryptocoins, cryptotokens, and the crypto market in general are speculative in general without proper regulatory authorities and frameworks. Proceed with caution. This article is not sponsored by BERAchain and is not financial or investment advice.