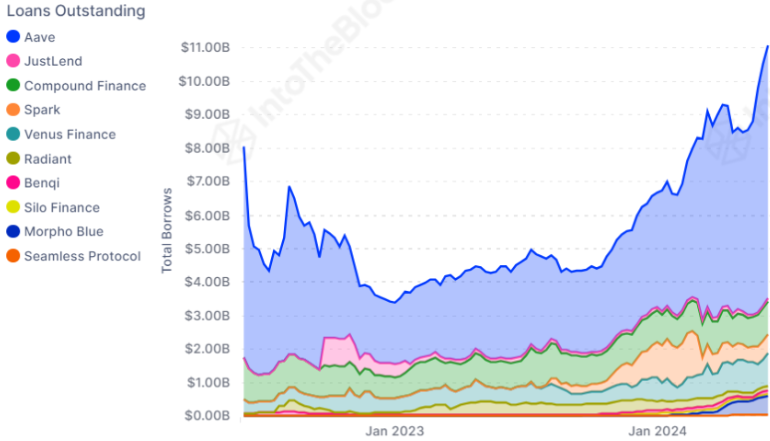

The decentralized finance (DeFi) landscape has witnessed a remarkable surge in recent times, with the total value locked (TVL) in DeFi loans reaching 11 Billion USDT, which is highest since two years. This exponential growth has been driven by a myriad of factors, including the relentless pursuit of higher yields, the evolving strategies of innovative DeFi lending platforms, and the increasing adoption of blockchain-based financial solutions. As the DeFi platform ecosystem continues to mature, understanding the dynamics behind this surge in DeFi crypto loans has become crucial for investors, developers, and industry stakeholders alike.

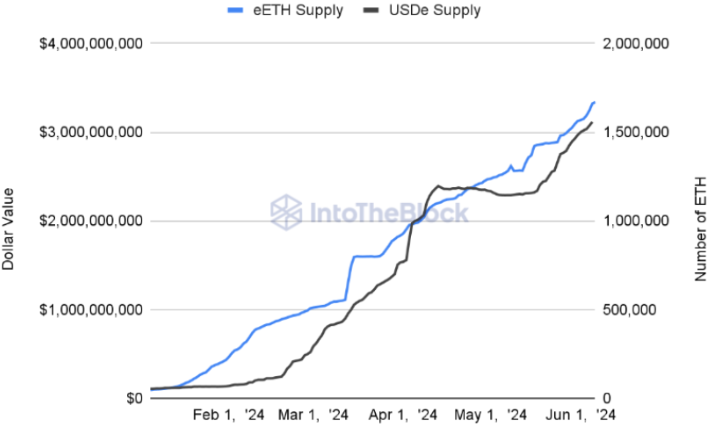

The supply of eETH by Ether.fi and USDe by Ethena has risen to $6.4 billion and $3.2 billion, respectively. The eETH from Ether.fi, a key component of the EigenLayer ecosystem, currently amounts to 1.7 million tokens. At the same time, USDe from Ethena has surged to become the fourth-largest stablecoin.

Recent data reveals that decentralized finance (DeFi) protocols have collectively generated over $11 billion in loans, reaching a peak not seen in the past two years. Aave’s V3 protocol stands out as it approaches a significant milestone, with nearly $6 billion in borrowed funds, establishing its dominance in the sector.

Moreover, the issuance of high-risk loans has surged to over $1 billion, signaling a higher level of market exposure among users. Notably, Aave’s V3 protocol has witnessed a notable increase in the use of weETH as collateral for ETH borrowing, amounting to over $1 billion. The adoption of weETH as collateral has experienced a substantial uptick following its inclusion in April.

At the heart of the DeFi loans surge lies the insatiable demand for higher yields. Investors, both institutional and individual, have been drawn to the lucrative returns offered by top DeFi lending platforms, which often outpace the yields available in traditional finance. This “yield chase” has fueled a surge in DeFi borrowing activity, as users seek to leverage their crypto assets to generate additional income streams and high rewards.

Innovative DeFi Lending Platforms

Complementing the yield chase is the emergence of innovative DeFi lending and borrowing platform development that have introduced novel features and strategies. Top crypto lending platforms like Ether.fi and Ethena have been at the forefront of this innovation, offering users unique DeFi loan options that cater to their diverse financial needs. These best DeFi lending platforms have leveraged cutting-edge technologies, such as decentralized oracles and automated market makers, to create more efficient and user-friendly lending experiences.

Driving Adoption through Accessibility

The accessibility of crypto lending platforms has also been a significant factor in the surge of DeFi loans. By lowering the barriers to entry and providing seamless onboarding processes, these bitcoin lending platforms have enabled a wider range of users to participate in the DeFi space. This increased accessibility has attracted a diverse pool of borrowers and lenders, further fueling the growth of the cryptocurrency lending platforms market and promoting financial inclusion.

Regulatory Landscape and Compliance Challenges

As the DeFi sector continues to evolve, the regulatory landscape has also come into sharper focus. Authorities and policymakers have been closely monitoring the DeFi space, with concerns over issues such as investor protection, market manipulation, and compliance with anti-money laundering (AML) regulations. The need for DeFi platforms to navigate these regulatory complexities has become increasingly critical, as non-compliance could result in significant legal and financial consequences.

Navigating the Regulatory Maze

DeFi platforms have had to develop robust compliance frameworks to address regulatory concerns. This has involved implementing know-your-customer (KYC) and AML procedures, ensuring transparency in their operations, and collaborating with regulatory bodies to establish clear guidelines for the industry. The ability of best DeFi platforms to effectively navigate the regulatory landscape, including aspects like credit scoring, has become a key differentiator in the competitive DeFi lending market.

The Impact on the Broader DeFi Ecosystem

The surge in DeFi loans has had a ripple effect on the broader DeFi ecosystem. As more capital flows into the decentralized lending and borrowing segments, it has fueled the growth of other DeFi verticals, such as decentralized exchanges, liquidity pools, lending pools, liquidity provision, yield farming, and staking rewards. This interconnectedness has led to a symbiotic relationship, where the success of DeFi loans has contributed to the overall expansion and maturation of the DeFi landscape.

Synergies with Emerging DeFi Trends

The DeFi loans surge has also intersected with other emerging trends in the DeFi space, such as the rise of decentralized autonomous organizations (DAOs), governance tokens, the integration of non-fungible tokens (NFTs) into lending protocols, and advancements in smart contracts. These synergies have opened up new avenues for innovation and user engagement, further driving the adoption and evolution of DeFi lending.

The Future of DeFi Loans: Challenges and Opportunities

As the DeFi loans market continues to evolve, it faces a range of challenges and opportunities that will shape its future trajectory. Addressing issues like scalability, cross-chain interoperability, and risk management will be crucial for DeFi platforms to maintain their competitive edge and ensure long-term sustainability.

Scaling for Mainstream Adoption

One of the primary challenges facing the DeFi loans market is the need for improved scalability. As user demand and transaction volumes continue to rise, DeFi platforms must find ways to optimize their infrastructure and processing capabilities to accommodate the growing user base. Advancements in layer-2 scaling solutions and the integration of layer-1 blockchain upgrades will be instrumental in enabling lending platforms to scale for mainstream adoption and institutional adoption.

Enhancing Interoperability and Cross-Chain Compatibility

The DeFi ecosystem has traditionally been fragmented, with various platforms operating on different blockchain networks. Improving multi-chain support and cross-chain compatibility will be a key focus for DeFi lending protocols, as it will allow for seamless integration and facilitate the flow of liquidity across different DeFi verticals and ecosystems. This will enable more efficient lending strategies, stablecoin lending, and the growth of decentralized stablecoins.

Mitigating Risks and Ensuring Stability

The DeFi loans market has also faced its share of risks, including smart contract vulnerabilities, liquidation cascades, and market volatility. DeFi platforms must prioritize the development of robust risk management frameworks, implement comprehensive security audits, and explore innovative solutions like flash loans, perpetual contracts, interest rate models, leveraged yield farming, self-repaying loans, overcollateralized loans, undercollateralized loans, real-world asset lending, and algorithmic rates to safeguard user funds and maintain the overall stability of the DeFi lending ecosystem.

Conclusion

The surge in DeFi loans has been a testament to the transformative power of decentralized finance. By offering high annual percentage yields, innovative lending solutions, and automated processes like collateralized lending, margin trading, and trustless transactions, DeFi platforms have captivated the attention of a growing number of investors and users. However, as the DeFi loans market continues to evolve, it must navigate the complexities of the regulatory landscape, address scalability challenges, and enhance interoperability to ensure long-term sustainability and widespread adoption. The future of DeFi loans holds immense promise, but the ability of the industry to overcome these obstacles will be crucial in shaping the next chapter of this dynamic and rapidly evolving financial landscape.

FAQs

What has been the recent surge in DeFi loans issuance?

Recent data shows DeFi protocols have issued over $11 billion in loans, marking a two-year high. Aave’s V3 protocol is nearing a borrowed funds milestone of $6 billion, leading the sector. High-risk loans have also peaked at $1 billion, indicating users’ increased market exposure.

How have innovative DeFi lending platforms contributed to the surge in DeFi loans?

Top crypto lending platforms like Ether.fi and Ethena have introduced novel features and strategies, leveraging technologies like decentralized oracles and automated market makers to create more efficient and user-friendly lending experiences.

What regulatory challenges are DeFi platforms facing in the current landscape?

Authorities are monitoring the DeFi space for issues like investor protection, market manipulation, and compliance with AML regulations. DeFi platforms are developing robust compliance frameworks, including KYC and AML procedures, to address these concerns.

What are the key challenges facing the future of DeFi loans?

Challenges include scalability, cross-chain interoperability, and risk management. DeFi platforms must optimize infrastructure, enhance interoperability, and mitigate risks to ensure long-term sustainability and widespread adoption.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. The author is not affiliated with any entities mentioned in the article. Please do your own research before engaging in any cryptocurrency-related activities. Hash Herald is not responsible for any loss in the market